Corrections, Recoveries and All That Jazz

Corrections, Recoveries and All That Jazz

Stock Market Corrections are tough on equity investors. Over the last couple of weeks, there has been nowhere to hide – normally defensive strategies provided little relief.

After a long period of minimal equity market hiccups investors were reminded that the opposite side of the return coin involves risk.

Equities do better than bonds, on average, precisely because investors require compensation for the additional risk of their investments.

If risk and return are tied together why do investors get so nervous when suddenly equity markets go haywire? Memories of 2008 come flooding back and investors get hyper fixated on relatively small market movements.

As of Friday, February 9, the S&P 500 had dropped 8.8% from its high of January 26. Granted the drop has been swift and intraday market action (the difference between the high and low of the day ) has been off the charts, but you would have thought that we were on the verge of another Financial Crisis.

Figure 1 depicts the rolling 12 month returns on the S&P 500 as of the end of 2017. There are more periods of positive rather than negative returns as expected. We can also see that the downdrafts in recent years have been painful for investors – the implosion of the Technology Bubble (2000-2002) and the 2008 Financial Crisis still very much linger in investor minds today.

Figure 1

The key insight that investors need to come away with from looking at the history of stock market returns is that to get the good (those returns averaging 10% a year) you must be prepared financially and most importantly emotionally to endure the bad (those nasty corrections).

Investors need to remember that risk and return are the opposite side of the same coin. They also need to understand the context in which market corrections take place. While history always rhymes every equity market correction possesses unique elements that shape its ultimate effect on investors.

Understanding the market and economic context is incredibly important for everyday investing. It is, however, absolutely critical for understanding the implications of equity market corrections and most appropriate course of action.

The point is that not all equity market corrections are made of the same cloth. Some are deep and lasting. Some are deep and over before the eye blinks. Others last for a year or two and progress at a slower rate. And, finally other corrections turn into cataclysmic events that leave investors bruised for a long time.

Given the events of the last couple of weeks we understand the skittishness of equity investors. Last year was fantastic for investors. We hardly had a hiccup in the last year. Investors started adapting to the environment – high returns and low volatility.

All the fireworks have come from Washington rather than Wall Street. Yet, the lingering suspicion is that this party like all others before it must end at some time. Maybe it is just time, right?

We are professional wealth managers, not magicians or fortune readers. Nobody knows when the next big stock market crash will happen and least of all nobody knows the severity of the downturn.

At best, we can analyze the current equity market downturn and attempt to better understand the context in which current equity market prices started heading south.

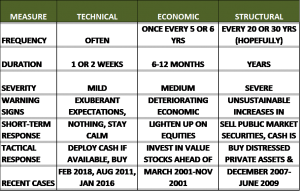

While all equity market downturns are unique, for simplicity sake we categorize periods of extreme equity market distress into three distinct types of corrections – technical, economic and structural. Each type of correction has its own distinct patterns and associated implications for investors. Not every moving animal in the woods is a Russian Bear!

Technical Correction:

This type of correction typically comes out of nowhere and takes market participants by surprise. One bad day for the stock market turns into 2 or 3 in a row and soon enough there is an avalanche of pundits predicting the next global crisis.

Maybe a bit surprising to some, pundits use perfectly logical arguments to justify their bearishness – inflation is about to spike up, the economy is tanking, earnings are coming down, there are no buyers left, and so forth.

All perfectly valid reasons for an equity market correction but the key characteristic of such prognostications is that they are mostly based on speculation and not rooted in contemporaneous economic trends. The arguments are more based on what we fear as opposed to what the current reality is.

Technical Corrections tend to occur on a regular basis especially for higher risk asset classes such as equities. Long-term equity investors have seen these before and do not seem fazed by the market action.

Newer generations of investors, however, experience great fear and regret. The immediate response is to sell down usually their most liquid holdings and wait for the market to calm down. Maybe they will get in again after the panic is over.

Technical Corrections tend to last only about a week or two. In the context of long-term capital market history they barely register to the naked eye. Boom they are gone, and people quickly forget what they just went through. Technical corrections are learning opportunities but are most often quickly forgotten until the next blip.

Economic Corrections:

These types of capital market corrections are caused by the economic business cycle, i.e., periods of economic expansion followed by recession and eventual recovery. Typically, the clues as to whether the economy is heading into a recession are present ahead of time.

Usually a large number of economic indicators will point in the same direction. For example, the yield curve may become inverted (long rates lower than short-term rates), business confidence surveys start showing some downward trends, companies start hoarding cash instead of investing in plant and equipment and layoffs start accelerating in cyclically sensitive sectors.

In the last half century, business cycle recessions have been mostly shallow and short-lived. Economic recessions are, no doubt, painful but the implications to investors are fairly straightforward.

In the early stages of a recession, equity investments suffer the most while bond market strategies tend to provide the upside. As the economy starts recovering, equity investments outperform marginally but with significant volatility.

Being early is never comfortable but it beats being late. Some of the best equity returns happen during the late early stages of a recovery when the average investor is still too snake bitten to put any money at risk.

And finally, as the economy moves into full expansion mode equity investors typically enjoy a nice margin of outperformance relative to safer assets such as bonds. As the uncertainty regarding the economic recovery fades in the rear view, capital markets tend to become less volatile as well.

Structural Corrections:

These are the most severe type and involve periods of real economic and financial stress. Something has gone off the rails and public capital markets are the first to feel the brunt of the economic imbalances.

Structural Corrections are not merely stronger business cycle events. The integrity of the entire economic and financial system is at stake. Without decisive fiscal and monetary policies there is a risk of total economic collapse. Under these circumstances, equity investors are often completely wiped out and bond holders don’t fare much better.

Structural Corrections happen during periods of total economic unravelling. The most usual signs of eminent economic collapse are massive unemployment, huge drops in productive output, and the unavailability of credit at any cost. The financial system is usually at the root cause of the crisis and liquidity in the system suddenly disappears. Faith in the system dries up overnight – the first stop are banks, next are capital markets.

The Great Depression of 1929-39 and the Financial Crisis of 2007-09 are prime examples of Structural Corrections that were felt across the globe. History is, however, littered with other instances of more localized cases such as the 1997 Asian Crisis, the 1998 Russian Default and the Argentinian collapse of 1999-2002.

What should investors do during a correction?

The answer depends on the context surrounding the capital markets at that moment. For example, the implications of a Technical Correction are very different from those of a Structural Correction.

Misdiagnosing what type of correction you are in can have severe consequences for your financial health. Becoming too risk averse and selling everything can be as harmful as not being risk-aware enough and always expecting the markets to recover irrespective of business and capital market conditions.

Finding the right balance is key. In reality, after many years of watching markets one is never really 100% sure of anything. In fact, if anybody says that they have perfect certainty all it means is that they either have not done all their homework or that they fail to understand the statistical concept of probability.

Our preferred approach is based on a solid understanding of capital market behavior coupled with hands-on experience under a variety of capital market situations. Understanding capital market history is the prerequisite but experience is the key extra ingredient to gain confidence in properly evaluating the context in which markets are experiencing distress.

Table 1 provides a checklist as to the type of issues that we consider when evaluating the type of correction we might be in.

Table 1

Where are we today?

As of February 12 we have already seen signs of recovery, but the S&P 500 is still down 7.5% from its January 26 peak. Investors remain nervous. The CBOE Volatility Index stands at close to 27% which is significantly higher than where it was before the equity market started convulsing.

A 7.5% drawdown on the S&P 500 is not that uncommon. Investors should be wary but also keep their eye on their long game of growing risk-adjusted portfolio returns.

We believe that the current equity market downdraft falls under the category of a Technical Correction. Why? The numbers back up our assertion. Our view is that equity markets remain healthy and will out-perform lower risk alternatives such as bonds.

Let’s start with a rundown of the negatives about equity markets. The biggest knock on equity markets is that they are over-valued relative to historical norms such as price-to-earnings ratios. Agreed, the current Shiller P/E stands at 33.6 relative to a historical average of 17. For access to the latest Shiller data click here.

On an absolute basis the S&P 500 is over-valued. When considered relative to interest rates the picture changes. Estimates by Professor Domadoran at NYU, for example, yield fair valuations on the S&P 500.

What else? Interest rates are too low. Agreed again, but low yields are the problem of the bond investor. A low cost of money is actually good for equity investors.

What about rising interest rates? The 10 Year US Treasury Note hit a low of 2.05% in early September and has been rising since. It currently stands at 2.84%. Higher, for sure. A real danger to equity markets? Not quite, especially in light of low rates of inflation.

Inflation-adjusted yields (sometimes called real yields) are still significantly below historical norms.

Higher real rates imply lower equity values. We agree, but we see the current upward progression of interest rates in the US as fairly well telegraphed by the Federal Reserve.

We also still believe that US monetary policy is accommodative. For example, Federal Reserve Bank of Atlanta estimates generated by the well-known Taylor rule show current Fed Funds rates about 2% too low (read here for a review).

What about the positives regarding equity markets? For one, we have a strong global economy. Every major economy in the world is in growth mode. The IMF recently raised their estimate of global GDP growth to 3.9% for both 2018 and 2019.

Inflation seems under control as well. The IMF estimates that global inflation will run 3.2% in 2018, unchanged from last year. Inflation in the US ran at 2.1% in 2017.

Monetary policy remains accommodative. In the US the Fed reserve is slowly weening investors off artificially low interest rates, while in most other parts of the world (Europe and Japan in particular) central banks have yet to embark on the process of normalization.

The recently enacted lowering of the US corporate tax rate is also a positive for US domiciled companies. Lower corporate tax rates translate immediately into higher cash flows. Higher cash flows translate into higher corporate valuations. The main beneficiaries of lower corporate taxes are ultimately shareholders.

What should investors do today?

Our analysis of the data leads us to the conclusion that the current equity market correction is driven by technical considerations and not fundamental issues.

We do not know how long the equity downdraft may last, but we expect this blip to barely register in the long-run.

Our advice may be rather boring but plain-vanilla seems the best response to the current state of investor panic.

- If you were comfortable with your financial plan at year-end, do nothing. Don’t obsess over every single market gyration. There is not enough evidence to merit an increase in fear or a significant re-positioning of your portfolio towards safer asset classes such as bonds

- If you did not have a plan in place, don’t go out and sell your equity holding before figuring out the status of your financial health in relation to your goals. Consult a certified financial planner if you need help.

- If you have some cash on the sidelines, deploy some of it in the equity markets. Given that all major equity markets have taken a beating spread your money around a bit. We still rate International Developed Markets and Emerging Markets as attractive. Consider whether it makes sense for you to put some money in the US and some abroad.

Whatever you do don’t panic. Focus on your asset allocation in relation to your needs, goals and appetite for risk. Don’t let that Russian Bear get to you!

Taking risk and suffering the inevitable equity market drawdowns is part of investing. Be cautious but be smart. Talk to your Advisor if you need help. Make your money work for you!