[thrive_headline_focus title=”Can You Sleep At Night?” orientation=”left”]

When choosing an investment or an investment advisor we pay great attention to investment results. We all want the highest possible return on our investments . Most of us understand that the more risk we take the more gain we may make, but also the more we may lose. It is a wonderful thought to consider how much we might make, but it is very prudent and wise to consider how much we might lose if things go bad. What can YOU afford to lose? Does the risk in YOUR portfolio match your needs?

The average gain of the S&P 500 from the start of 2010 to the end of 2014 was 15.45% . Quite a nice average gain and one that most professionals believe cannot be expected to continue in the long term.

In the bear market of the recent Great Recession, the S&P 500 lost over 54.9% of its value from October 9, 2007 to March 9, 2009 . If you had stayed invested in the S&P500 throughout the same period, you would have needed an estimated 122% return for your investment to return to its pre-recession level.

If instead in the same period you had been invested 50% in the S&P 500 and 50% in the Barclays US Aggregate Bond Index, you would have lost approximately 23.84%. You would have then needed a return of only 31.35% for your investment to return to its pre-recession level.

Obviously, this example is hypothetical. There are many other factors that weigh into portfolio design. Although real life portfolios will often contain many more components, this simple example illustrates the benefits of diversification, and the importance of managing risk in a portfolio.

It is up to you and your financial planner to judge the risk that you can afford, and up to your financial planner to help you implement a portfolio that reflects that risk.

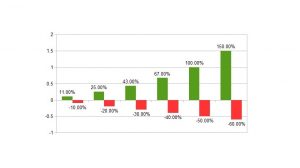

The bar chart to the left will allow you to estimate the amount of gain required to offset any loss that you might have experienced.

How did 2015 do for you? At the end of November 2015 the S&P 500 was up 3.01% for the year . Many investors with all stock , and therefore, high risk portfolios, are still down for the year, and perhaps still not sleeping well.

What to do? After a financial planner has assessed your risk capacity, he/she will be able to recommend a fully diversified portfolio that includes all relevant asset classes to match your financial objectives.

Note: The above hypothetical example is based on historical performance of the S&P 500 and Barclays US Aggregate Bond Index using Morningstar data. You cannot invest in indices. Trading and management fees are not computed in the example. This is not investment advice, which can only be given individually based on your risk tolerance and circumstances.

A previous version of this post appeared in the Colonial Times