[thrive_headline_focus title=”4 Counter-Intuitive Steps to Take Now to Make Your 401(k) Rock” orientation=”left”]

With the demise of traditional defined benefit plans, 401(k)’s provide the most popular way for individuals to save for their retirement.

With the demise of traditional defined benefit plans, 401(k)’s provide the most popular way for individuals to save for their retirement.

401(k)’s are also the second largest source of US household wealth right behind home equity.

According to the Investment Company Institute there were over 55 million active participants in 401(k) plans plus millions of former employees and retirees as of the end of last year. The amount of money is staggering at $5.3 trillion as of the end of 2017.

Given the importance of 401(k)’s to US household financial health you would think that plan participants would watch their balances like a hawk and actively manage their holdings.

Some people do, but the vast majority of people do not truly understand what they own or why. Most people know that the more they contribute to their 401(k) the higher their ending balances are going to be, but beyond that there is a lot of confusion.

Many people do not make 401(k) choices naturally. Many participants do not even know where to begin when it comes to:

-

What funds to select

-

How much to allocate to each fund

-

Deciding on the proper amount of risk to take

-

Understanding how their 401(k) fits in with the rest of their financial picture

When given a choice, people usually start with the issue or problem that they perceive as the easiest to figure out, not necessarily the one of greatest importance.

Many people approach the problem of how to invest their 401(k) in a simplistic manner.

Many 401(k) participants start off by selecting funds. For most participants this is not an easy choice, but in comparison to the other issues this one appears manageable.

But sadly, 401(k) participants are getting it backwards by picking funds first. They are not framing the problem correctly.

Picking funds before figuring out your goals and objectives is like picking furniture before you know the size and shape of your dining room. It might work out but it would involve a lot of luck. Do you want to count on luck when it comes to your financial future?

A different way of addressing the challenge is to start the other way around. Start with the end goal in mind.

Re-frame the problem to first figure out what you are trying to do. You want your 401(k) to work for you and your family, right? Sound like a better starting point?

Without knowing what you are trying to do and what really matters to you putting money into your 401(k) loses meaning.

[pullquote align=”normal”]What funds to select [/pullquote]

First figure out for yourself why you are taking money out of your paycheck to put into your 401(K). What is your “why”?

The answer may be obvious to you, but when money gets tight due to some unforeseen life event you will be glad that you have a tangible picture for its ultimate use.

Visualize what you are going to do with that money. Is it for a retirement full of adventure? Is it for buying that dream sailboat that you’ll take around the world? Or, is it simply to preserve your lifestyle once you retire? Money has no intrinsic value if you don’t spend it on things that matter to you and your family.

“Money cannot buy peace of mind.

It cannot heal ruptured relationships, or build meaning into a life that has none.”

— Richard M. DeVos, Billionaire Co-founder of Amway, Owner of Orlando Magic

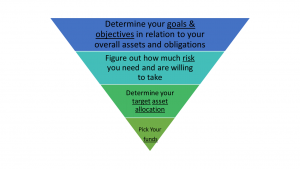

So, if starting with the end in mind makes sense to you, let’s take a look at the four counter-intuitive steps that you can take now to make your 401(k) work for you. Figure 1 lays it all out.

Figure 1

Step 1: Define what matters to you and inventory your resources

Visualize your goals and objectives for the type of life you and your family want to lead. Don’t just think about your retirement – think as broadly as possible.

Close your eyes, visualize, pour a nice glass of cabernet for you and your partner before you have the “talk”, write it down in your journal – whatever approach gets you out of your everyday busy persona and makes you focus on what you really want out of life.

How do you want to use your money to accomplish this lifestyle?

Maybe you and your spouse want to engage in missionary work in 10 years. Maybe you also need to fund college expenses for your children? Maybe you see a lakefront house in the near future? There is no cookie cutter approach when it comes to people’s dreams! It’s up to you to make them up.

Your 401(k) assets are just one component of your household wealth . Think about your other assets and financial obligations. And don’t forget to include your partner’s or spouse’s.

Your house, your emergency fund, investments in mutual funds, possibly a little inheritance, company stock. Almost forgot, your spouse’s 401(k) and that condo that he/she bought before you met. Take a comprehensive inventory of your assets.

How much debt do you have? That is part of your financial picture as well. Do you anticipate paying your mortgage off in the next few years?

Wealth managers talk about a concept called the household balance sheet. It’s the same idea that financial analysts use when evaluating a company. In the corporate world you have assets, liabilities and the difference is net worth. In your own world you have assets, obligations and unfunded goals, and net worth is the difference.

Sounds a bit harsh when it involves you, right? Don’t take it personally. The key idea is taking an inventory of what you own, what you owe and then matching that up to your goals and aspirations.

Step 2. How aggressive do you need to be while being able to sleep at night

The whole idea of saving and investing is about making your goals and aspirations a reality. If you already have enough assets to fund your desired lifestyle into perpetuity then you don’t really have to worry too much about investing. Just preserve what you got!

If you are like most people, you need to make your investments work for you. You need a return on your assets.

It’s a good idea to be realistic about goals and objectives. Are your goals reachable? Is there only a tiny probability of reaching them?

Are your goals a stretch, reachable with some effort, or a slam dunk?

Your answer will dictate how aggressive you will need to be in your investment strategy.

- If your goals are a stretch you need high return/high risk investments – be ready for a volatile ride and many highs and lows

- If your goals are within reach using conservative asset class return assumptions you need a moderate return/moderate risk portfolio – you will still experience fluctuations in your portfolio that will leave you feeling anxious at times, but the periods of recovery will more than make up for the periods of stress

- If your goals are a slam dunk, you are lucky and you will only need low return/safe investment strategies – your portfolio values will not fluctuate much in the short-term but your portfolio will also not grow much in size

To some extent this is the easy part. There is a link between risk and return in the capital markets. Higher risk usually translates over long periods of time into higher returns. Equities do better on average than bonds and bonds in turn do better than money market investments. So far so good.

Figuring out the required rate of return to fund your goals and objectives given your resources involves math but little emotional contribution.

But what about your emotions?

This is the tricky part. Many people are able to conceptualize risk in their heads, but are entirely unable to deal with their emotions when they start losing money.

They think of themselves as risk takers but can’t stand losing money. They panic every time the stock market takes a dip. It does not matter why the market is tanking – they do not like it and run for the exits.

But an honest assessment of both your need to take risk as well as your comfort level with investment fluctuations is necessary in managing your long-term financial health. You will see massive cracks if these two dimensions of risk are not aligned.

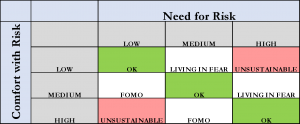

Let’s examine a simple situation where we classify your need and comfort level with investment risk in three states: low, medium and high.

Figure 2 lays out all the possibilities. Ideally, your two dimensions of risk will match up directly. For example, if your need for risk is low and your comfort level with taking risk is low you are all set. Same if you need a high risk/high return strategy to meet your goals and objectives and you are comfortable experiencing significant fluctuations in your portfolio.

Figure 2

The real problem for you is, however, when the two dimensions of risk are not aligned. You’ll need to resolve these differences as soon as possible to regain any hope of financial health.

Let’s say you are really risk averse. You fear losing money. Your worst case scenarios (bag lady, eating cat food) keep popping up in your nightmares. If your goals and objectives are ambitious in relation to your resources (high need for risk) those nightmares will not go away and you will live in fear.

You can do one of two things – learn to live with fear or, scale back your goals and objectives. There is no right or wrong answer – it’s up to you but you must choose.

What if you are comfortable taking on lots of investment risk? Would you like a low risk/low return portfolio? Probably not. In fact, such a portfolio would probably drive you crazy even if you did not need any higher returns.

People comfortable with investment risk frequently suffer from fear of missing out (FOMO). They think that they should be doing better. They want to push the envelope whether they need to or not.

FOMO is as damaging of an emotion as living in fear. Both states spell trouble. You will need to align both dimensions of risk to truly get that balance in your financial life.

Step 3. Determine the asset allocation consistent with your goals and risk preferences

Sounds like a mouthful, right? Let’s put it in plain English. First of all, the term asset allocation simply refers to how much of your investment portfolio you are putting into the main asset classes of stocks, bonds and cash/bills.

Sure, we can get more complicated than that. In our own research we use ten asset classes, but in reality breaking up the global equity and bond markets into finer breakouts is important but not critical for the average individual investor.

Figuring out the right range of stocks, bonds and cash is much more important than figuring out whether growth will outperform value or whether to include an allocation to real estate trusts. Do the micro fine tuning later once you have figured out your big picture asset allocation.

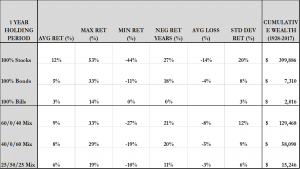

All right, since we are keeping things simple let’s look at some possible stock/bond/cash allocations. We are going to use information from our IFS article on risk and return. As a reminder the data used in these illustrations comes courtesy of Professor Aswath Domodaran from NYU and covers US annual asset returns from 1928 to 2017.

Table 1

The top half of the table shows the performance and volatility of stocks, bonds and cash/bills by themselves. From year to year there is tremendous variability in returns but for the sake of simplicity you can use historical risk and returns statistics as a rough guide.

Here is what you should note:

- If you need high risk/high portfolio returns and you can take the volatility go with a stock portfolio with average historical returns of 12%. On a cumulative basis nothing comes close to stocks in terms of wealth creation but you should expect a bumpy ride

- If you only need low risk/low returns and you are extremely risk averse go with cash/bill type of portfolios returning, on average, 3%. This portfolio is probably just going to keep up with inflation

- If you have a medium tolerance for risk and medium need for taking risk then you will likely gravitate toward a combination of stocks, bonds and cash

- There is an infinite number of combinations of asset class weights – the three asset allocations in the bottom panel of Table 1 may very well apply to you depending on your risk tolerance, need for return and time horizon

What about the stock/bond/cash mixes?

- The 60% stock/40% bond allocation has over this 1928-2017 period yielded a 9% return with a 12% volatility. Historically, you lost money in 21% of years but if you are a long-term investor the growth of this portfolio will vastly outstrip inflation

- The 40% stock/60% bond portfolio is a bit less risky and also has lower average yields. When a loss occurs, the average percentage loss is 5%. This portfolio may appeal to a conservative investor that does not like roller coaster rides in his/her investment accounts and does not need the highest returns.

- The 25% stock/50% bond/25% cash portfolio is the lowest risk/return asset class mix among our choices. Historically this portfolio yields an average return of 6% with a volatility also of 6%. This portfolio may appeal to you if you are naturally risk averse and have a low tolerance for portfolio losses, but you might want to also check whether these returns are sufficient to fund your desired goals and objectives

Step 4. It’s finally time to pick your funds

Yes, this is typically where people start. Many times people pick a bunch of funds based on a friend’s recommendation or simply based on the brand of the investment manager. Rarely do people dig deep and evaluate the track record of funds.

A lot of people pick their funds and declare victory. They are making a huge mistake. They are not framing the problem correctly.

The problem is all about how to make your 401(k) work for you in the context of your goals and objectives, your resources and your comfort with investment fluctuations.

Picking funds is the least important part. You still have to do it but first figure out what matters to you, your need and comfort with risk and your target stock, bond, cash mix.

Once you have your target asset allocation go to work and research your fund options. Easier said than done, right?

Here are some fund features that you should focus on:

- Passive or Active Management – a passive fund holds securities in the same proportions as well-known indices such as the S&P 500 or Russell 2000. An active fund is deliberately structured to be different from an index in the hope of achieving typically higher returns

- Fund Style – usual distinctions for equity funds are market capitalization, value, volatility, momentum and geographic focus (US, international, emerging markets). For bond funds the biggest style distinctions are maturity, credit and geographic focus

- Risk Profile – loosely defined as how closely the fund tracks its primary asset class. Funds with high relative levels of risk will behave differently from their primary asset class. Accessing a free resource such as Morningstar to study the basic profile of your funds is a great starting point. For a sample of such a report click here

- Fund expenses – these are the all in costs of your fund choices. Lower costs can translate into significant savings especially over long periods of time. In general, index funds tend to be lower cost than actively managed funds

Understanding what makes a good fund choice versus a sub-optimal one is beyond the financial literacy and attention span of most plan participants.

For most people a good rule of thumb to use is to allocate to at least two funds in each target asset class.

Let’s make this more concrete. Say your target asset allocation is 60% stocks and 40% bonds. Most 401(k) plans have a number of stock and bond funds available.

What should you do? A minimalist approach might entail choosing an S&P 500 index fund and an actively managed emerging market equity fund placing 30% in each. This maybe appear a bit risky to some so maybe you only put 10% in the emerging market fund and 20% in a US small capitalization fund.

Same on the bond side where you might allocate 20% to an active index fund tracking the Bloomberg US Aggregate index and 20% in a high yield actively managed option.

Let your fund research dictate your choice of funds. You should keep things simple.

Know what funds you own and why. Keep your fund holdings in line with your asset allocation. Spreading your money into a large number of fund options does not buy you much beyond unneeded complexity.

Most of your 401(k) performance will be driven by your target asset allocation anyway.Picking funds that closely match the risk and return characteristics of your asset classes (say stocks and bonds) is good enough.

Trying to micro-manage the selection of funds will not likely lead to a huge difference in overall portfolio returns.

______________________

Conclusion:

The task facing you in managing your 401(k) may seem daunting at times. You may feel out of your own depth.

You are not alone but if you reverse the usual way in which most participants manage their 401(k)’s you should gain greater control over your long-term financial health.

Start with the end in mind. What is this money for? Think about your life goals and objectives. Depending on your resources, you will need to figure what type of risk/return portfolio combination you will need as well as how comfortable you are dealing with the inevitable investment fluctuations.

Lastly, keep it simple when choosing your funds. You have figured out the important stuff already. Pick at least a couple of funds in each of your target asset classes by performing some high level research from sites such as Morningstar and MarketWatch.

Keep in mind that more funds do not translate into higher levels of diversification if they are all alike. Know what you own and why.

If this is all just too much for you, consider hiring Insight Financial Strategists to review your 401(k) investment allocations. We will perform a comprehensive analysis of your asset allocation and fund choices in relation to your stated goals and objectives while also keeping your expressed risk preferences in mind.

The analysis will set your mind at ease and make your 401(k) work for you in the most effective manner. We are a fee based fiduciary advisor, which means we are obligated to act solely in your best interest when making investment recommendations.