Physicians face unique financial challenges. Although they are typically high earners, physicians often find themselves behind by the time that they complete residency or fellowship.

At that time, researching financial issues to make informed wealth decisions can be time consuming and a bit overwhelming. As with any other field of specialty, you need a partner and adviser who will walk alongside you as you navigate your unique financial challenges.

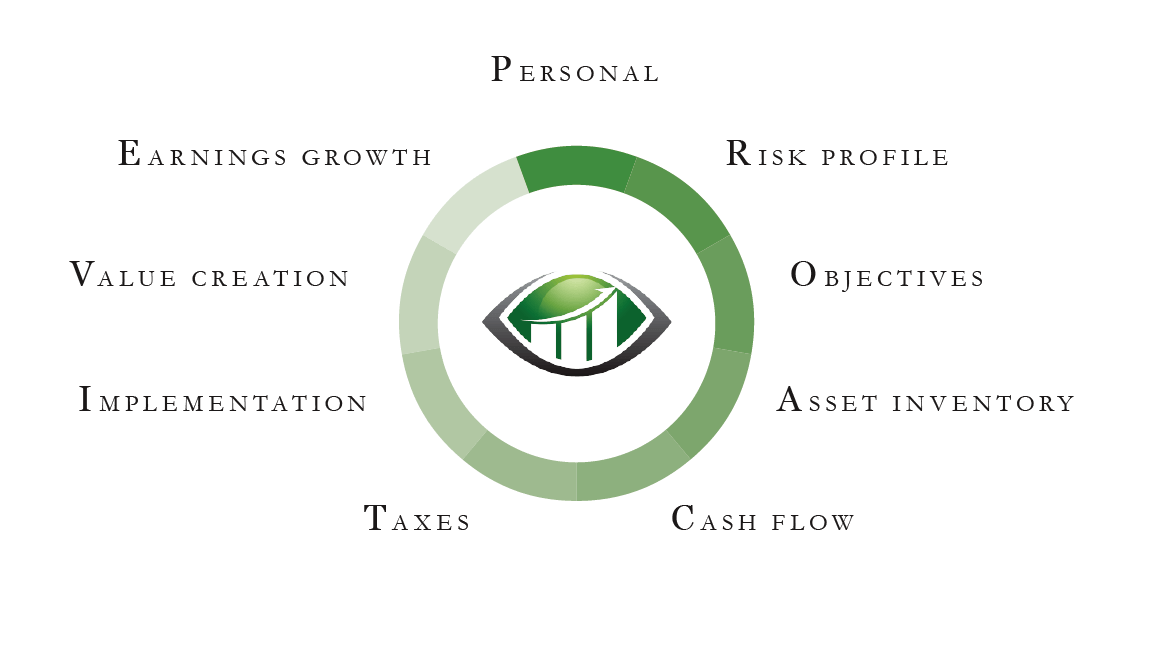

Just as your patients trust you with their health, our clients trust us with their finances. Our comprehensive strategy covers all aspect of wealth management, from debt planning and servicing to risk management, legacy planning, education, philanthropy, retirement planning, and of course, investments.

As fiduciary advisers, we are committed to your best interests. We are only compensated with your fees. We never take a commission.

We help you take control of your finances to position you for the bright and secure financial future that you have worked so hard for. Our goal is to take care of you while you take care of your patients and enjoy your family.

We help physicians live their ideal life by addressing your key concerns through appropriate strategies that are developed for your unique needs.

- What is the best way to pay off my medical school loans?

- How to plan for multiple goals, such as paying off debt, paying for children's college, and saving for retirement?

- How to manage retirement plans?

- How do I implement a unified investment strategy?

- How do I invest with the appropriate amount of risk for my goals and situation?

- How to plan with tax consequences in mind?

- How to evaluate your insurance needs?

Many of our clients live in Lexington MA, Arlington MA, Bedford MA, Concord MA, Newton MA, Boston, Brookline MA, Belmont MA, Lincoln MA, Watertown, Wellesley MA, Cranston RI, East Greenwich RI, Barrington RI, Portsmouth RI, Saunderstown RI, and Providence RI.