Making Your Post-Divorce Portfolio Reflect the New You

Making Your Post-Divorce Portfolio Reflect the New You

Divorce is the final step of a long process. Whether the marriage was long or short, the end of marriage brings about the conclusion of an important phase of your life.

Divorce is an emotional event sometimes anticipated years in advance and at other times coming totally out the blue.

In all cases whether anticipated or not, divorce is a stressful event. According to the Holmes-Rahe Life Stress Inventory Scale divorce ranks as the second most stressful event that a person can experience in a lifetime.

Typically when you divorce you end up with an investment portfolio that is ½ of your old couple’s portfolios. Invariably, your new portfolio will not be suitable anymore. If you haven’t been the “financial” person in your marriage you may not even know what you own.

Most likely you will need to make changes to your portfolio to suit your new situation. You are now also solely responsible for your financial health.

Your post-divorce portfolio should reflect your updated needs, objectives and comfort level with investment risk. This may not be what you bargained for or you may feel ill-prepared to handle this on your own. You may feel that your life is out of your sync, but aligning your financial assets to your new situation is entirely under your control.

Why do you need a new portfolio once you divorce?

For one, the dollar amounts are less than before and your current investment strategy reflects your goals as a couple rather than your own objectives going forward.

Moreover, most likely your confidence is a bit shot and your desire to take much investment risk is lower than before.

Ok, are you with me? You can control this aspect of your new life. What steps should you take to get the ball rolling?

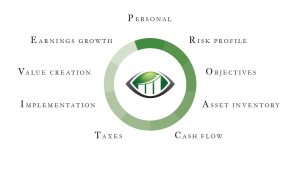

We suggest an approach rooted in our P.R.O.A.C.T.I.V.E methodology.

The first step involves thoroughly examining your new situation from a non-financial standpoint. Where do you want to live? What type of lifestyle are you looking for? If you have children what type of issues do you need to account for?

The second step is to re-evaluate your comfort with taking investment risk. Now that you are solely in charge of your financial life how do you feel about taking on risk? Are you comfortable with the inevitable stock market swoons that occur periodically? Are you able to think as a long-term investor given your recent divorce?

The next step is really important. Your post-divorce portfolio needs to work for you. Establishing a hierarchy of financial objectives will drive the type of strategy that is most appropriate for you.

Is your primary objective to save for retirement? Do you have any major objectives besides retirement? Maybe you need to fund college tuition for your two kids. Maybe you plan on buying a new home in 2 years once your life has settled down?

Next you need to deal with the nitty gritty of figuring out exactly what you own and cash flow budgeting. What you own should not be difficult to figure out as you have just gone through the divorce process.

The second part of cash flow budgeting is often highly sensitive for people not used to budgeting during their marriage. If you have never had a budget or stuck to one this step seems like a major imposition. But unless money is so plentiful you have no choice.

At least for a period of time you will have to keep track of your expenses and gain an understanding of where the money is going. The reason this is important is that you may need to tap into portfolio gains to fund your living expenses. If that is the case, your portfolio should be structured to write you a monthly check with a minimal amount of risk and tax consequences.

The next step in the P.R.O.A.C.T.I.V.E process is to evaluate your tax situation. If you are in a high tax bracket you might want to favor tax-advantaged investments such as municipal bonds. If your income is going to be taking a hit post-divorce you probably will end up in a lower tax bracket increasing the attractiveness of a Roth conversion to your traditional individual retirement account.

The last three steps all involve figuring out how best to construct your investment portfolio. Going from your pre-divorce portfolio to something that fits your needs and goals will usually require some major re-adjustments in your strategy.

Going through our P.R.O.A.C.T.I.V.E process or a similar approach is probably the last thing you want to do on your own. Most likely you will need the help of an advisor to work through this.

Keep in mind that the reason you are doing this is to regain control over your financial life. You sought the help of a lawyer during your divorce. Now is the time to move forward and seek the help of financial professionals with an understanding of your situation and new set of needs.

What is the best way to implement a portfolio strategy for newly divorced people?

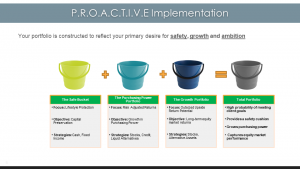

The most important aspect of post-divorce portfolio is that it fits you and your new circumstances and desires. Using our P.R.O.A.C.T.I.V.E methodology as a framework for evaluating your needs and desires we suggest implementing a portfolio structure that encompasses three “buckets”.

A “bucket” is simply a separate portfolio and strategy that has a very specific risk and return objective. Each bucket in our approach is designed to give you comfort and clarity about its role in your overall portfolio.

What is the role of these “buckets”?

Each “bucket” has a very specific role in the overall portfolio as well as very explicit risk and reward limits.

We label our three “buckets” as the Safe, the Purchasing Power and the Growth portfolios.

The role of the Safe Bucket is to provide liquidity and cash flow to you to meet your short-term lifestyle needs. How much you have invested in your Safe portfolio is a function of how much money you need to fund your lifestyle over the next few years.

The second bucket – the Purchasing Power portfolio – is designed to allow you to enhance your lifestyle in terms of real purchasing power. What this means is that every year your portfolio should have a return exceeding inflation.

Finally, the third bucket – the Growth portfolio – is designed to grow your portfolio in real terms. This portfolio is designed to maximize your returns from capital markets and will be almost exclusively invested in higher risk/higher reward equity securities.

Conclusion:

Going through divorce is one of the most stressful situations anyone can face. Transitioning to a new beginning may take a short term for some but for most people the period of adjustment is fraught with uncertainty and doubt.

People often worry about their finances and whether they can maintain their lifestyle. A life event such as divorce also tends to shorten people’s horizon as their outlook in life often lacks clarity.

The implications from an investment standpoint are primarily a temporarily diminished desire to take on portfolio risk and a shortening of time horizons. In English this translates to searching for greater certainty and not looking too far out.

As wealth managers our first goal is to first understand the client’s circumstances and needs once the divorce is finalized. Our P.R.O.AC.T.I.V.E process serves as the framework for initiating and exploring client concerns and issues.

Our P.R.O.A.C.T.I.V.E approach is designed to make your money work for what you deem important. Divorce is difficult and transitioning to a new beginning takes time. As you adjust to your post-divorce life your financial assets will also need to be managed consistent with the new you.

At Insight Financial we are experts at guiding you through this difficult adjustment period and transition into a new beginning. To read our full report on our approach for managing your post-divorce investments please click here.

Our wealth management team at Insight Financial Strategists is ready to help you in your transition. To set up an initial consultation please book an appointment here.

Other posts you may find interesting

4 Risks of Pension Plans in Divorce