Do-It-Yourself (DIY) Investors have been cropping up everywhere since the end of the 2008 Financial Crisis.

DIY investors tend to be well-educated professionals of reasonable means that prefer to build their own portfolios without the help of an investment professional.

They educate themselves about investing by reading a number of investment books (here is a popular one for Bogleheads) and subscription-based services espousing the benefits of the DIY approach.

A lot of DIY investors identify strongly with Jack Bogle, the founder of Vanguard for his dedicated approach to index investing.

One thing that distinguishes today’s crop of DIY investors from the original crop back in the 90’s is that today’s investors are much more focused on exchange-traded funds (ETF) as compared to individual stocks. A large number of inexpensive and liquid ETF’s have made this possible.

The primary appeal of DIY investing revolves around gaining control over your portfolio.

You are in charge and make all decisions. From selecting a specific ETF to all buy and sell decisions. A secondary appeal of DIY investing is cost – if you are the manager of your own portfolio you save yourself the fee that would have gone to your investment advisor. Typically this fee amounts to about 1% of the value of your portfolio.

DIY investors tend to do well when capital markets exhibit low volatility and the trend in price is well established. Everybody loves up-trending markets that don’t fluctuate much. But as Humphrey Neill, a famous contrarian investor used to say “Don’t confuse brains with a bull market”.

The analogy I like to use is that of a pilot. When everything is calm even a novice will look good. But when the friendly skies become turbulent, a novice pilot will likely tense up and the odds of making a mistake will increase significantly.

DIY investors face the same situation. During periods of calm, portfolio decisions will come easily. The cost of a poor decision is not likely to have major consequences in such a benign environment.

But when the capital markets get dicey, the implications of one’s actions increase dramatically. A poor decision could decimate the value of your portfolio and seriously harm your overall financial health.

My contention is that when the rubber hits the road, many DIY investors are ill-equipped to deal with extreme capital market uncertainty.

Stock market corrections are not fun for anybody, but experienced investment managers have the real benefit of having seen a movie of the same genre before.

I have lived through the 1987, 2000-2002 and 2008 stock market meltdowns. None of these were fun but I learned valuable lessons in each of these crises. Mainly I learned not to panic but also ways to course correct once it became clear that action was required. A key insight is that changing fundamentals require changing portfolio compositions.

Many DIY investors have not seen a real crisis in their investment lifetimes. While everybody can read about stock market crashes unless you live through such a period it is hard to truly assimilate their impact both on your pocketbook but more importantly on your psyche.

A crisis such as 2008 is extremely disorienting even for professional investors, but the advantage that experience and knowledge of capital market behavior afford you is a game plan honed by the school of hard knocks.

Without the benefit of having lived through previous periods of real capital market stress and the knowledge of how markets typically behave, DIY investors are at a significant disadvantage.

The potential for errors during a crisis goes up exponentially. Three common reactions or mistakes that we have seen from DIY investors involve:

1. Selling Everything in a Panic

No questions asked, just get rid of everything that is taking a hit before it gets even worse. Taking action by selling everything may give the DIY investor a sense of relief. But making decisions in a highly charged emotional state is asking for trouble.

If the decision to sell is based on solid research and is well thought out, fine. But if it is based on impulse and an immediate need to get rid of the stress then it is most likely that the portfolio was not appropriate for the individual in the first place. Investing comes with volatility, there is no way around this!

Oftentimes when an investor sells in a panic the most troubling decision is when to buy in again. Even worse if the decision to sell turns out to be wrong, the investor will endlessly question themselves and lose confidence in their ability to navigate on their own.

DIY investors tend to focus on the initial portfolio composition or asset allocation but often fail to plan ahead should market conditions change. And if there is one thing that holds true is that change is inevitable and an ongoing part of financial markets. Planning ahead for changing market conditions is an integral component of a well-designed investment plan.

Fortunately, most DIY investors know that impulsively selling everything in a panic is not a good wealth creation strategy. But don’t kid yourself – in a market meltdown you will want to sell everything and more!

You will have to control your emotions and have the stomach to weather the inevitable periods of market turbulence.

2. Becoming extremely risk-averse and freezing up even if action is clearly needed

Most market corrections are short-lived and while painful in the short-term they barely register on the long-term map. For example, in 2018 we have already had a couple of equity market corrections but in each case, the market recovered its losses fairly quickly.

No harm, no foul! Doing nothing or standing pat works just fine when markets recover.

The bigger problem for investors is when corrections take on a bigger life and become outright market crashes. For example, the S&P 500 was down three straight years from 2000 to 2002. What do you do when the roof seems to be caving in?

Many DIY investors close their eyes and pretend that this is not happening to them. They get frozen and choose to ignore reality. This is not an abnormal reaction at all for us humans, but we also know that small problems many times lead to big problems if we do not address the underlying issue.

Wishing the problem away does not work. From the field of behavioral finance, we know that investors tend to hang on to their losing investments way too long. The flipside is that research has also shown investors to sell their winners way too soon. This effect is known as the disposition effect.

The price of financial assets such as stocks is a function of fundamentals (growth and profitability), the fair price of those fundamentals (investment multiples) and the sentiment of buyers and sellers.

During a period of crisis, the tendency of DIY investors is to focus almost exclusively on sentiment. When sellers want out now and buyers are scarce the price will automatically come down.

You observe falling prices and you get more and more uncomfortable. But is there any real economic information in investor sentiment?

Experienced investors while not immune to the same feelings of fear will look at the underlying fundamentals and the value of those fundamentals. Experienced investors know that investor sentiment is fickle and lacks much predictive ability.

Has something changed recently to warrant this drop in market values? Are growth rates and profitability permanently impaired, or is the market overreacting? Are investors reacting to the perception of market over-valuation? These are all questions that require some real expertise and most importantly an understanding of context.

There is no cookie cutter way to analyze market action making the experience in similar conditions coupled with knowledge of historical market behavior all that much more valuable.

DIY investors often lack an understanding of context and an assessment of prospective fundamentals in the face of wildly fluctuating capital market conditions. The tendency by many is to stand pat, but what if changing market fundamentals require a change in portfolio positioning? Intentional investing often requires action.

3. Failing to assess the changing risk levels of their portfolios

A frequent mistake made by DIY investors is to focus almost exclusively on returns and ignore the risk and correlation structure of their portfolios.

Much of the thought behind DIY investing hinges on ideas derived from Modern Portfolio Theory (MPT) but somehow you hardly ever hear DIY investors justify changing allocations based on the volatility structure and composition of their portfolios.

A related mistake is to often assume diversification benefits that often are not there when you need them most. A good read on “fake diversification” can be found here.

Ignoring changing asset volatility and correlation is a serious mistake made by many non-professional investors. In fact, one could say that by ignoring the volatility structure of portfolios DIY investors are ignoring some of the lowest hanging fruit available.

As Nobel Prize Winner Harry Markowitz once said: “diversification is the only free lunch provided by capital markets”.

As capital markets change over time so will the risk characteristics of a portfolio even if rebalanced periodically to static weights.

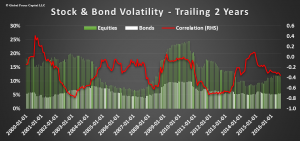

In a study done a couple of years ago on portfolio rebalancing, I showed just how much stock and bond volatility and correlations can change over time.

Figure 1

Stock volatility, in particular, can move quite a bit around. Bond volatility while still variable shows much lower variability. And, correlations between stocks and bonds can move between positive and negative values implying large changes in diversification potential for a portfolio.

Say, a DIY investor has a portfolio composed of 60% US stocks and 40% US Bonds. The DIY investor diligently rebalances this portfolio every month so that the weights stay in sync. What would this 60/40 portfolio look like in terms of volatility?

Using the above study over the 2000 to 2016 period, the average volatility of this 60/40 portfolio would average 8%. Assuming that the average volatility would not change much would be a mistake. The range of volatility goes from 4% to 15% as shown in Figure 2.

Even the old standby 60/40 portfolio exhibits wildly fluctuating levels of portfolio risk. A 4% volatility level implies a much lower level of potential downside risk compared to a portfolio with a volatility of 15%. Experienced investment professionals inherently understand this and often seek to target a narrower pre-defined range of portfolio volatility.

Figure 2

DIY investors do not often construct portfolios targeting an explicit range of risk. Instead, the often hidden assumption is that over the long-term asset returns, volatilities and correlations will gravitate toward their “normal” levels. These assumptions are not supported by the empirical evidence.

For DIY investors, changing levels of volatility and correlations can cause significant changes to the risk/returns characteristics of their portfolios. For example, volatility tends to spike up during periods of capital market stress and remain low when markets are trending up.

Also, correlations among investments within the same asset class (broadly speaking equities, bonds and alternatives) tend to also jump up during periods of crisis leading many to question the benefits of asset diversification. What investors should be questioning instead is why they did not re-adjust their portfolios to reflect the changing conditions.

_________________________________________________________________________

Conclusion:

DIY investing is here to stay. Many non-investment professionals have educated themselves as to the virtues of retaining control over their portfolios. After all, DIY investors are saving themselves the fee that they would normally pay their advisor for managing their portfolio.

When markets trend up and volatility is low, DIY investors will typically fully participate in the gains.

But there is another “cost” that DIY may be incurring on their own that often rears its ugly head especially during periods of capital market turbulence.

We are all human and we suffer from the same biases and fears. The difference is that experienced professional investors have the advantage of having seen similar periods of capital market stress before and possess a more nuanced perspective of normal capital market behavior.

DIY investors tend to make three types of mistakes during a crisis – they chuck it all in a panic, they freeze up and do nothing, and, lastly, they ignore changing levels of portfolio volatility.Professional investors while prone to the same fears as the DIY crowd are better positioned to focus their attention on the fundamentals of investment performance -growth, profitability & valuation – that ultimately drive portfolio values.

Experience and knowledge gained over many market cycles are at a premium when your portfolio most needs it. At Insight Financial Strategists we are experts in integrating your financial planning needs with your investments.

You do not have to go at it alone and compete against the pros. Our investment approach is rooted in the latest academic research and implemented using low-cost investment vehicles.

Interested in talking? Please schedule a complimentary consultation here.