[thrive_headline_focus title=”Third Quarter 2018″ orientation=”left”]

Should we panic yet?

September 2018 marked the 10 year anniversary of the Lehman Brothers bankruptcy in 2008, that ushered several months of extreme activity in the financial markets. The market slide from December 2007 to March 2009 was one of the steepest and scariest that we remember.

Yet, ten years later, the S&P 500 has enjoyed the longest bull market in US history, having lasted 3,453 days from March 9, 2009, until the end of September 2018. (footnote: Dow Jones Indices and Washington Post) As has been the case throughout its history US markets have recovered and more than made up the losses of the last downturn. According to Morningstar, the S&P 500 returned an annual 12% from October 1, 2008, to September 30, 2018. On a cumulative basis, the S&P 500 has returned by 210%.

This rally has been largely fueled by the easy monetary policy of the Federal Reserve, which moved short-term interest rates effectively to zero in the wake of the 2008-2009 bear market, promoting risky behaviors, especially with corporate borrowing, which have helped drive the U.S. stock market upwards since then.

We all want to know when the next market downturn will occur. Some may think that it has started already with the October 2018 volatility. Since we cannot predict the future with any accuracy, we’ll stipulate that it may well have. However, we believe that the October market reflects a reversal to the greater volatility that the financial markets have historically displayed instead of the placid pace that we have been accustomed to since the Great Recession. We should get used to more of the same in the future.

We are likely to be in the late innings of the current economic expansion. However, there are reasons for a cautiously positive outlook for the short term. Either for the short or long run, it continues to be important to match the risks of your investments with the need you will have for the funds. (If you are not sure what I am talking about here, drop me a line). If your needs for your money is in the short term, invest appropriately.

With proper matching of asset risk and liability timing, you can be well prepared for the downturns that will inevitably come.

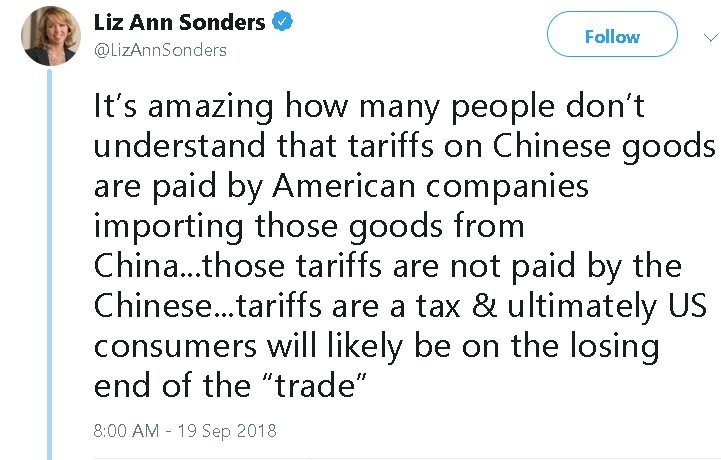

A New Round of Tariffs

In late September, the U.S. placed an additional round of tariffs on $200B of Chinese goods. They are expected to affect a wide range of products, from computer electronics to forestry and fishing.

In response, China accused the Trump administration of bullying and applied their own tariffs on $60B worth of goods. If the Chinese response looks weak, it is only because China imports a lot less from the US than we do from them! That should not be reassuring as China has many other tools to retaliate with besides imposing tariffs on American goods.

According to Fitch, the rating agency, these trade escalations will have a negative impact on global growth. As a result, they lowered their economic growth forecasts slightly from 3.2% to 3.1%.

In its simplest form, a tariff is a tax imposed on imported goods. Eventually, it gets paid by consumers. There are already anecdotes of the effects of the tariffs on the price and availability of some products. Coupled with the tariffs imposed by China, we expect that they will work themselves in the numbers in quarters to come.

Consumer Confidence Near All-time High

American consumers continue to be oblivious to the effects of trade and tariff risks. The Conference Board’s Consumer Confidence Index hit an 18-year high and sits very close to an all-time high, due in part to a strong outlook on economic growth and low unemployment.

Speaking of unemployment: it fell to 3.7% in September 2018, well below the 50- year average of 6.2%. Normally, we expect low unemployment to be associated with wage inflation. Fortunately for employers, although not for workers, wage growth has remained stagnant well below historical averages.

The Era of Easy Money is Coming to an End

In each of the last four quarters, the Federal Reserve increased the Fed Funds rate 25 basis points (bps). It now stands at a level of 2.00% – 2.25%. We have had three increases already in 2018 and 8 since 2015. It is possible that the volatility that we experienced in October 2o18 may delay the projected December 2018 increases. However, at this time, owing to the otherwise strong economy, we expect that the increase will come through, and will be followed by two more increases in 2019.

Inflation Is Stable

The Core PCE (Personal Consumption Expenditures), a measure of inflation, is running right around the Fed target of 2%. From the Federal Reserve perspective, that is good news, as inflation has persisted below this mark for the last several years. Inflation is one of the key economic measures that the Fed watches very closely. When interest rates climb faster than anticipated, it may signal an overheating economy and inflation. The Fed may then increase interest rates more quickly.

U.S. Equity

Reversing last quarter when small-cap stocks outperformed large-cap stocks, this quarter saw large-cap stocks outperform their small-cap counterparts as trade and tariff talk dissipated. In addition, large-cap stocks are still benefiting from the effects of the tax cut. Even so, on a year-to-date basis, small-cap stocks have still outpaced large-cap stocks 11.5% to 10.5% as of the end of September.

From a style perspective, the last quarter continued to increase the gap between growth and value stocks. On a year-to-date basis, large-cap growth stocks, as represented by the Russell 1000 Growth, have outperformed large value stocks, as represented by the Russell 1000 Value by 13.2% (17.1% vs. 3.9%).

Non-U.S. Equity

International equities have continued to lag their U.S. counterparts in 3Q2018. In fact, the MSCI EAFE was the only major international equity index we follow that earned a positive return during the quarter (1.4%). Additionally, each of the four major international equity indexes we follow have fallen on a YTD basis.

During 3Q, much of the conversation in emerging markets surrounded Turkey and Argentina. Turkey’s direct impact on the overall return of the MSCI Emerging Markets index was minimal as it comprises only 0.6% of the MSCI Emerging Markets Index. However, because Argentina comprises almost 16% of the MSCI Frontier Markets Index, its troubles certainly had a greater impact on returns. We expect that MSCI will reclassify Argentina into the MSCI Emerging Markets Index in mid-2019.

Emerging markets continue to have strong growth and attractive fundamentals. Specifically, they are considerably less expensive from a P/E ratio perspective and pay higher dividends.

However, the Fed rate increases have hurt, as US rate hikes have a tendency to increase the value of the dollar, and decrease the attractiveness of emerging market investments. Also, while the U.S. comprises 55% of global market capitalization, 45% continues to come from outside our borders.

Therefore, despite occasional challenges, we believe that it is important for investors to be diversified in markets outside the U.S. Investors should keep in mind that investing domestically vs. internationally should not be an all-or-nothing endeavor. We continue to believe that global diversification is important.

Fixed Income

Fixed income investments continue to be challenged in a rising rate environment. Specifically, Treasury investments have yielded negative returns over the last 12 months. The picture worsens with longer maturities and most other fixed-income categories.

We continue to keep an eye on the shape of the yield curve. When the 2 year and 10 year Treasuries (the yield curve) come to close together, it is often a precursor of recession. That happens when investors no longer believe that they are being adequately compensated for holding longer maturities. This year the gap between the two has continued to narrow and therefore has fueled speculation. As of now, the curve has not inverted (ie short-term rates are still lower than long-term rates). Therefore, the best we can say is that this indicator is inconclusive at this time.

In anticipation of continued fixed income market turmoil due to rising rates and other factors, our fixed income portfolio is weighted toward shorter maturities and floating rate instruments. We believe that this provides an adequate return at an acceptable risk.

Check our blog post on the Seven Year End Wealth Management Strategies

Note: The information herein is general and educational in nature and should not be construed as legal, tax, or investment advice. Views expressed are the opinions of Insight Financial Strategists LLC as of the date indicated, based on the information available at that time, and may change based on market and other conditions. We make no representation as to the accuracy or completeness of the information presented. This communication should not be construed as a solicitation or recommendation to buy or sell any securities or investments. To determine investments that may be appropriate for you, consult with your financial planner before investing. Market conditions, tax laws, and regulations are complex and subject to change, which can materially impact investment results. Index performance information, financial conditions, inflationary and future risk and return information is provided for illustrative purposes only. One cannot invest directly in an index. Past performance is no guarantee of future results. Individual investor performance may vary depending on asset allocation, the timing of investment, fees, rebalancing, and other circumstances. All investments are subject to risk, including the loss of principal.

Insight Financial Strategists LLC is a Massachusetts Registered Investment Adviser.