[thrive_headline_focus title=”Year End Tax Planning Opportunities” orientation=”left”]

The Tax Cut and Jobs Act of 2017 (TCJA) was the most consequential tax reform package in this generation. It changed many of the ways that we think about reducing taxes.

According to the Tax Policy Center, we know that about 80% of taxpayers pay less income tax in 2018 than before the TCJA , about 5% pay more, and the balance of taxpayers pay about the same amount. On balance, the TCJA seems to have delivered on its promises.

A key item of the TCJA is that it increased the standard deduction, reducing the impact of the elimination of State and Local Taxes (SALT) under $10,000 and the elimination of personal deductions. As a result, about 84% of taxpayers claim the standard deduction and do not itemize. By comparison, about 56% of taxpayers itemized before the enactment of the TCJA. The vast majority of taxpayers are no longer subject to the Alternative Minimum Tax (AMT), since two of its key drivers, the deductibility of state and local taxes and personal deductions, are no longer a practical issue for most people. And in 2018, only 1,700 estates were subject to the federal estate and gift tax. So for most people, the TCJA has made taxes simpler to deal with. What’s there not to like about a simpler tax return ?

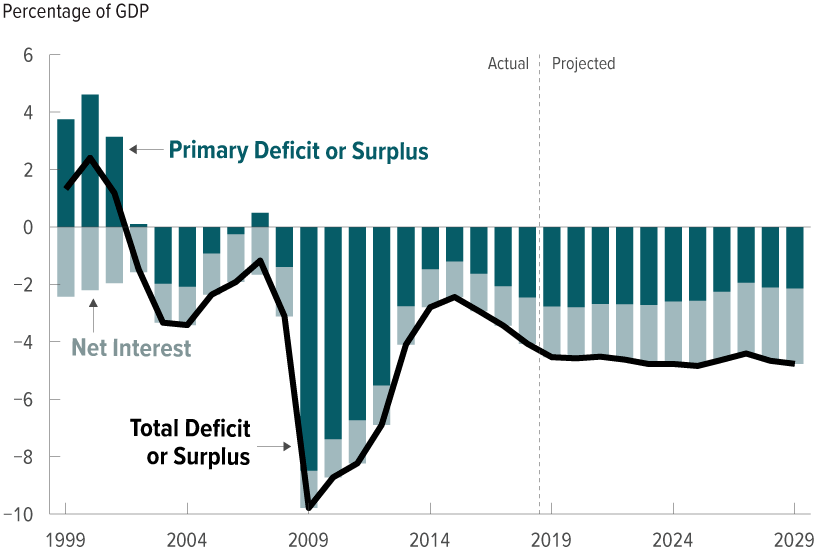

Source: Congressional Budget Office

Impact of the TCJA on the Federal Deficit

As predicted, the TCJA worsened the federal deficit bringing it to nearly a trillion dollars in fiscal year 2019. That was in spite of an increase in tax revenue due to the continuing improvement in the economic climate. Of course, the federal deficit continues to be driven by federal spending on the sacred cows of modern US politics: Defense, Social Security, and Medicare. Interest on the federal debt is also a major budget item that needs to be paid. While our continuing regime of low interest rates is helping control the interest on the debt, it is clear that the future may change that.

What will happen to tax rates?

Tax rates are lower now than they have been since the 1970s and 80s. Hence, industry insiders tend to think that tax rates have nowhere to go but up. That is also what’s is predicted by the TCJA, which is largely designed to sunset in 2025. Should the American people turn on Republicans at the 2020 election, it’s possible that the TCJA will see a premature end. However, it seems that the possibility that the American people might elect a progressive in 2020 is largely discounted when it comes to tax rate forecasting: most people assume that tax rates will increase.

Year-End Planning

Political forecasting aside, there are still things that we can do to lower our taxes . It should be noted that many of the techniques in this article are not limited to the year-end. Furthermore, we all have different situations that may or may not be appropriate for these techniques.

Tax Loss Harvesting

Even though we have had a pretty good year overall, many of us may still have positions in which we have paper losses. Tax-loss harvesting consists of selling these positions to realize the losses. This becomes valuable when you sell the equivalent amount of shares in which you have gains. So if you sell some shares with $10,000 in losses, and some with $10,000 in gains, you have effectively canceled out the taxes on the gains.

You then have to reinvest the shares sold into another investment. Be careful not to buy back the exact same shares that you sold. That would disallow the tax loss harvesting!

At the same time, it makes sense to review your portfolio and see if there are other changes that you would like to make. We are not fans of frequent changes for its own sake. However, periodically our needs change, the markets change, and we need to adapt.

Income Tax Planning

While tax loss harvesting is mostly about managing Capital Gains taxes, it is also important to keep an eye on income tax planning . This is a good time of year to estimate your income and your taxes for the year. When comparing your estimated Adjusted Gross Income with the tax tables, you will see if you might be creeping up into the next tax bracket. For instance, if you are single and your estimated AGI is $169,501 (and you have no other complexity), you are right at the 32% tax bracket (after you remove the $12,000 standard deduction). In this example, that means that for every dollar above that amount you would owe 32 cents in federal income tax, and a little bit more for state income tax, if that applies to you.

If your income is from a business, you may possibly defer some of that income to next year. If your income comes from wages, another way to manage this is to plan an additional contribution to a retirement account. In the best of cases your $1,000 contribution would reduce your taxes by $320, and a little bit more for state taxes.

In some cases, you might have a significant dip in income. Perhaps if you have a business, you reported some large purchases, or you booked a loss or just had a bad year for income. It may make sense at this point to take advantage of your temporarily low tax rate to do a Roth conversion. Check with your wealth manager or tax preparer.

If your income does not straddle two tax brackets, the decision to invest in a Traditional IRA or a Roth IRA is still worth considering.

Charitable Contributions

By increasing standard deductions, the TCJA has made it more difficult for people to deduct charitable contributions . As a result, charitable contributions bring few if any tax benefits for most people.

One way around that situation is to bundle or lump charitable gifts. Instead of giving every year, you can give 2, 3 or more years worth of donations at one time. That would allow your charity to receive the contribution, and, potentially, for you to take a tax deduction.

Pushing the bundling concept further, you could give even more to a Donor Advised Fund (DAF). With that option, you could take a tax deduction, and give every year from the DAF. That allows you to control your donations, reduce your income in the year that you donate, and potentially reduce income taxes and Medicare premiums. Consult your wealth strategist to ensure that taxes, income, and donations are optimized.

Retirement Accounts

First, it is important to review Required Minimum Distribution (RMDs). Anyone who is 70 ½ years of age or older is subject to RMDs. Please make sure to connect with your financial advisor to make sure that the RMD is properly withdrawn before the year-end.

The RMD is a perennial subject of irritation for people . Obviously, if your retirement income plan includes the use of RMDs, it’s not so much of an issue. However, if it is not required, it can be irritating. That is because RMD distributions are subject to income taxes that may even push you into the next tax bracket or increase your Medicare premium. There are, however, some ways that you can deal with that.

For instance, if you take a Qualified Charitable Distribution (QCD) from your IRA and have the distribution given directly to a charity, the distribution will not be income to you. Hence you won’t pay income taxes on that distribution, and it will not be counted toward the income used to calculate your Medicare premium. However, it will fulfill your RMD, thus taking care of that pesky issue.

Generally, we advocate planning for lifetime taxes rather than for any one given year. Lifetime financial planning has the potential to result in even more benefits. It should be noted that many of the possibilities outlined in this article can be used throughout the year, not just at year-end. We encourage you to have that conversation with your wealth management team to plan for the long term!