[thrive_headline_focus title=”The Best Way to Pay Off Federal Student Loans” orientation=”left”]

In my previous article about private student loans, I mentioned that students should consider taking out federal student loans before taking out any private loans.

Federal student loans have protections and benefits that private student loans most likely won’t have . Federal loans can be discharged if the borrower dies or becomes totally and permanently disabled. Also, borrowers may have access to Income-Driven Repayment (IDR) plans and loan forgiveness programs.

Table of Contents

Income-Driven Repayment Plans

Sarah was an example from my previous article. She is a physician making $250,000 a year and has a federal loan balance of $250,000 with a 6% interest rate. Sarah learned that she could save a lot of money by privately refinancing her federal loans. But are there any benefits for Sarah to keep her loans in the federal system?

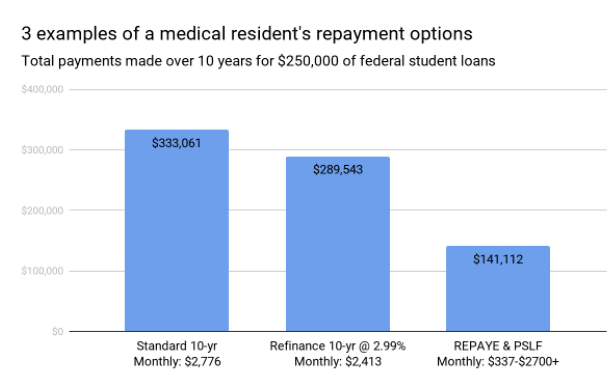

What if she is thinking about starting a family and possibly working part-time but does not know when that might happen? She wants to pay off her debt as fast as she can but does not like the idea of having required payments of $2,776 a month on the federal 10-year Standard repayment plan or $2,413 a month after private refinancing when her income temporarily decreases for working part-time.

By keeping her loans under the federal system, Sarah has some flexibility over the amount she must pay every month. First, she can pay more than her minimum monthly payment in any repayment plan if she wants to pay her loans off faster. She may also have the option to enroll in one of the Income-Driven Repayment plans and make much lower payments when and if her income decreases.

How are monthly payments calculated for the IDR plans?

Under the Income-Driven Repayment (IDR) plans, the borrower’s required minimum monthly payment is calculated based on a portion of the borrower’s income. The borrower may not be required to pay back the full amount of his/her loans. That is unlike the federal Standard repayment plan or private loans, which require the borrower to pay the principal and the interest of the loan in full over a specified term. For example, if Sarah got married, had a child, and her income temporarily decreased to $150,000, she may qualify for one of the IDR plans, such as the Pay-As-You-Earn (PAYE) repayment plan. Then her monthly minimum payment could be reduced to $978.

IDR and Public Service Loan Forgiveness

To see how IDR plans and forgiveness programs work together, let’s look at another example. Jimmy is a recent medical school graduate making $60,000 a year in a residency program with $250,000 of federal student loans. He feels that it would be difficult to pay $2,776 every month in the 10-year Standard plan or $2,413 a month after refinancing. He is wondering if he should apply for forbearance to suspend payments until he can afford the high payments as an attending physician, just as one of his classmates from medical school, Tom, has decided to do after graduation.

Instead of applying for forbearance, Jimmy should consider enrolling in an IDR plan (and so should Tom). For example, in the Revised-Pay-As-You-Earn (REPAYE) repayment plan, he would be required to make monthly payments based on 10% of his income for a maximum of 25 years, and the remaining balance would be forgiven and taxed as income. If Jimmy’s loans are eligible for REPAYE, his monthly payment would start at $337, which would free up $2,439 a month compared to the Standard plan! But why should Jimmy choose to make payments when he has the option to suspend payments using Medical Residency Forbearance?

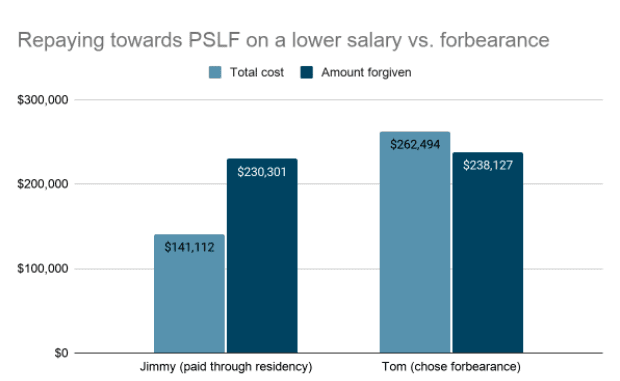

It becomes apparent when you consider how forgiveness programs work. To see how much money they could potentially save with one of the forgiveness programs, let’s say that both Jimmy and Tom will be working for a nonprofit or a government employer while they repay their loans, making them candidates for Public Service Loan Forgiveness (PSLF).

Under the PSLF program, Jimmy would only make 120 payments in an IDR plan (REPAYE in his case) based on his income and get the remaining balance forgiven tax-free, which means that he should try to repay as little as possible. Assuming that he gets his monthly payments calculated based on his resident salary of $60,000 for five years before he starts making $250,000, he can be done with his loan payments after ten years of payments totaling about $141,00! Compared to the standard 10-year repayment plan in which he pays a total of $333,061, including principal and interest, he would save over $190,000 by pursuing PSLF.

Low IDR payments may be better than no payment

Because Jimmy started his PSLF-qualifying payments based on his lower salary as a resident, he gets his loans forgiven earlier and pays less in total compared to Tom, who chose forbearance and waited to enroll in an IDR plan and pursue PSLF until after residency. Assuming that Tom had the same loans and circumstances as Jimmy but made all of his PSLF-qualifying payments based on a $250,000 salary, Tom would pay a total of around $263,000, which is over $121,000 more than what Jimmy paid in total.

As you can see, it is important to explore your options if you have student loans (especially federal student loans) and have a strategy that aligns with your life and career plans . It can save you tens or hundreds of thousands of dollars. Perhaps more importantly, knowing that you have a plan and are in control of your debt can help you prepare for life events and give you peace of mind. However, it is a complicated process full of traps. If you are not sure what to do with your student loans, schedule a free 15-minute student consultation with me here!

*A version of this article has also been published on Kiplinger. Read it here.