[thrive_headline_focus title=”Is the new Tax Law an opportunity for Roth conversions?” orientation=”left”]

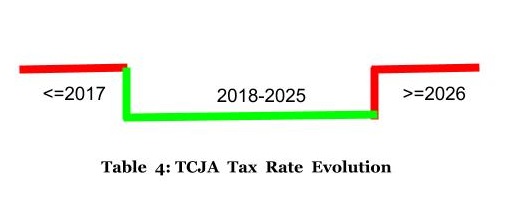

The New Tax Law, known as the Tax Cuts and Jobs Act (TCJA) was passed in December 2017. Its aim was to reduce income taxes on as many constituencies as possible. One of the well known implementations of that desire has been the temporary reduction of individual income tax rates. That provision of the law is scheduled to sunset in 2025. Starting in 2026, individual income tax rates will revert back to 2017 levels, resulting in a significant tax increase on many Americans, following 8 years of reduced tax rates.

Assuming Congress doesn’t take future action to extend the tax cut, how can the damage of the TCJA’s scheduled tax increase be mitigated? One way to mitigate the damage of the TCJA scheduled tax increase could to switch some retirement contributions from Traditional accounts to Roth accounts from 2018 to 2025 , and switching back to Traditional accounts in 2026 when income tax bracket increase again.

[pullquote align=”normal”]The TCJA has a tax increase built into it [/pullquote]

It’s well known that contributions to and withdrawals from Roth IRAs and Roth 401(k)s are taxed differently than their Traditional cousins . One of the major factors to consider when deciding between a Roth IRA or a Roth 401(k) and a Traditional IRA or Traditional 401(k) are income tax rates during working years and in retirement.

Generally speaking, Roth accounts are funded post tax, whereas a Traditional accounts are funded pre-tax . As a result, funding a Traditional 401(k) account reduces current taxable income , usually resulting in lower current taxes. Similarly, you may be able to deduct your contributions to a Traditional IRA from your current tax liability depending on your income, filing status, whether you are covered by a retirement plan at work, and whether you receive social security benefits. Income taxes must be paid eventually, so retirement distributions from Traditional IRAs and 401(k)s are taxed in the year in which they are withdrawn. In fact, the Internal Revenue Service so wants retirement savers to pay income taxes that it mandates Required Minimum Distributions (RMD) from Traditional accounts after age 70 1/2 . RMDs are taxed as ordinary income in the year they are distributed.

On the other hand Roth accounts are funded with post-tax money and result in retirement distributions that are tax free, provided all requirements are met.

Roth IRAs and Roth 401(k)s

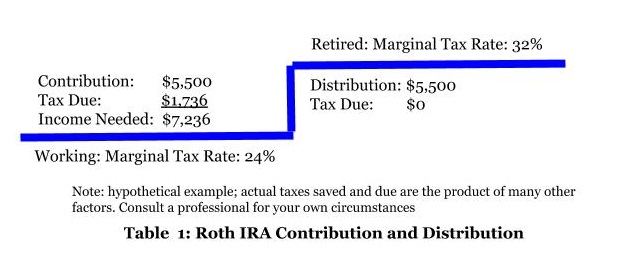

When working year taxes are lower than projected tax rates in retirement, it usually makes sense to contribute to a Roth account . In this situation, paying taxes upfront results in lower projected lifetime taxes. For instance, assuming that Vanessa is in the 24% tax bracket, she will need to earn $7,236 to make a $5,500 contribution to a Roth IRA. That is because, she will owe federal taxes of $1,736 on her earnings (not counting state taxes where applicable), leaving her with $5,500 to contribute. However, Vanessa’s distributions in retirement would be tax free. If her marginal tax rate in retirement is greater than 24%, she would have saved on her distributions.

It’s important to note that you can only contribute to a Roth 401(k) plan if your employer offers one as a company benefit . Married individuals filing jointly and making over $196,000, married individuals filing singly and making over $10,000, and single filers making over $133,000 cannot contribute to a Roth IRA, but may contribute to a Roth 401(k).

Traditional Accounts

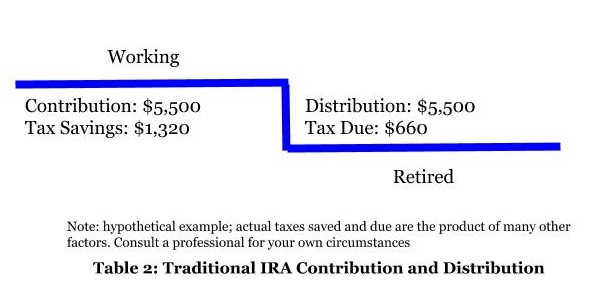

When working year tax rates are higher than projected tax rates in retirement, it usually makes sense to contribute to a Traditional IRA or Traditional 401(k) . Contributing to a Traditional account in that situation generally results in a reduction in taxes in the year of contribution; taxes will be due when the assets are withdrawn from the account, hopefully in retirement. For instance, If Vanessa contributes $5,500 to a Traditional IRA can result in a reduction in taxable income of $5,500. If she is in the 24% federal income tax bracket, Vanessa would save $1,320 in federal income taxes (not counting potential applicable state income taxes). If Vanessa is in the 12% marginal federal tax bracket in retirement, when she takes $5,500 in distribution, she would then owe federal income taxes of $660.

Most working people are in higher tax brackets while working than they will be in retirement; hence it usually makes sense for them to contribute to Traditional accounts . That is not true for everyone, of course, as individual circumstances can significantly affect taxes owed.

The New Tax Law

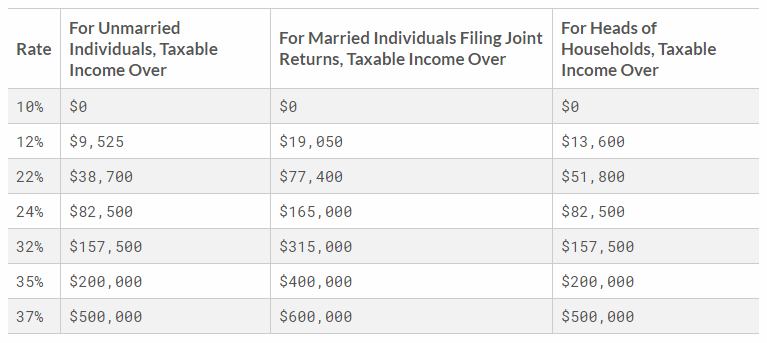

The new Tax law, aka the Tax Cut and Jobs Act or TCJA, passed in December 2017, comes with a number of features, including a permanent reduction in corporate taxes. Most important for individuals and families, it significantly reduces individual tax brackets starting in 2018.

Table 3: 2018 Federal Tax Brackets

However, while the tax decrease for corporations is permanent, the TCJA tax decrease for individuals and families is temporary. Starting in 2026, individual tax rates will be back to their 2017 levels .

In practice this will result in a large tax hike in 2026 for many individuals and families. For instance if Susanna and Kevin make $150,000 and file “Married Filing Jointly”, they might be in the 22% marginal tax bracket in 2018. With the same income in 2026, Susanna and Kevin would be in the 25% marginal tax bracket. Of course, there are several other factors that will impact their final tax bill, but most people in that situation will stare at a higher tax bill.

So what if Susanna and Kevin project that their retirement income would place them in today’s 22% bracket? Most likely that would put them in the 25% federal bracket in 2026, resulting in a possible tax increase. In fact, depending on the exact situation, a large number of Americans will see their taxes increase in 2026 as the result of the sunset of the TCJA individual tax cuts .

Consider a Roth Conversion while working

Susanna and Kevin could also take advantage of the temporary nature of the TCJA tax cuts to convert some of their traditional tax deferred retirement accounts to Roth accounts. In so doing, they would take distributions from the Traditional account, transfer to the Roth, and pay income taxes on the conversion. This way Susanna and Kevin would create themselves a source of tax free income in retirement, that could help them stay in their tax bracket and partially insulate them from future tax increases.

[pullquote align=”normal”]Now is the time to take steps to manage your taxes [/pullquote]

Because Roth conversions increase current taxable income, many people will find them a limited possibility as only so much funds can be converted without jumping into the next tax bracket. However, working people can also think in terms of changing their current contributions from Traditional 401(k)s to Roth 401(k)s. That would have the similar impact of increasing current taxable income and income tax due for the benefit of creating a reserve of future tax free assets.

Consider changing from a Traditional 401(k) to a Roth 401(k)

In the case of Susanna and Kevin, they could be in the 22% marginal federal tax bracket in 2018. If they retire in 2026, and their taxable income in retirement does not change, they may be in the 25% marginal tax bracket. For this couple, it may well be worth switching current contributions from a Traditional 401(k) to a Roth 401(k) from 2018 to 2025 , thereby increasing taxes due from 2018 to 2025, and potentially reducing taxes in retirement.

Of course, it is not always clear where Susanna’s and Kevin’s taxable income would come from in retirement. That is because their sources of income will likely change significantly. While they would no longer earn income, they may then have social security income, pension income, and retirement plan income which are all taxed as ordinary income. They may also take income from other assets with different tax characteristics, such as savings or investments. That might make the projection of their taxable income more difficult.

It is possible that Susanna and Kevin’s income needs will influence the tax characteristics of their income when they retire in 2026 or later; that may place them in a different tax bracket altogether. For instance Wealth Managers routinely advise clients to postpone Social Security income as late as they can, preferably until 70 in order to maximize lifetime social security income. When that happens it is possible that income between retirement and 70 could come from other sources, such as investments. When that happens taxable income could be significantly lower as investments are usually taxed at a lower capital gains rate.

This may sound self serving, but I’ll write it anyway: the best way to know what Susanna and Kevin’s income would look like in retirement, and how it might be taxed, is for them to check in with a skilled Certified Financial Planner. Otherwise they would just be guessing.

Considering a Roth Conversion in Retirement

So what about people who are already retired? The situation is similar. Take David and Emily, a retired couple with social security income, state pension income, and retirement plan income. From 2018 to 2025, their $100,000 taxable income places them in the marginal 22% federal tax bracket. With the same income in 2026, they would end up in the 25% tax bracket. Through no fault of their own David and Emily will see their income tax increase in 2026.

One of the ways that David and Emily can fight that is to convert some of their Traditional retirement accounts to Roth between 2018 and 2025, pay the income taxes on the additional income, and then use distributions from the Roth when their taxes go up in 2026 to stay within their desired tax bracket. In this way, David and Emily could potentially reduce their overall taxes over the long term.

Conclusion

The new Tax Law, aka the TCJA, reduces individual and family income federal tax rates substantially starting in 2018. However in 2026 individual federal income tax rates will go back up resulting in a significant tax increase for many American families . Roth conversions could help many plan to avoid the pain of this planned tax increase by balancing current lower taxes against future higher taxes. To do this successfully requires careful evaluation of current and future taxable income. Planning Roth conversions from 2018 to 2025 could pay significant rewards by lowering taxes after 2026.

The key challenge for retirement contributors would be to calibrate the right amount of Roth conversion or Roth contributions so as to minimize current and overall taxes owed.

Because each situation will be different, it will pay to check with a Certified Financial Planner to estimate future income and tax rates, and to plan a strategy that will maximize your financial well being.

Check out our other posts on Retirement Accounts issues:

Rolling over your 401(k) to an IRA

7 IRA rules that could save you time and money

Doing the Solo 401k or SEP IRA Dance

Tax season dilemna: invest in a Traditional or a Roth IRA

Roth 401(k) or not Roth 401(k)

Note 1: this post makes assumptions regarding potential individual tax situations. It simplifies the many factors that enter into tax calculations. It omits many of the rules that are applicable to Roth accounts and Roth conversions. It also assumes that the TCJA will be unchanged. None of these assumptions may be correct. Please check with the relevant professionals for your individual situation.

Note 2: Insight Financial Strategists LLC does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Insight Financial Strategists LLC cannot guarantee that the information herein is accurate, complete, or timely, and makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.