Congress passed SECURE 2.0 on December 23, 2022, and it was signed into law by President Biden on December 29, 2022, leading us to several significant changes in retirement planning . As the numeral indicates, SECURE 2.0 follows SECURE 1.0, which passed in 2021. SECURE 2.0 was long rumored but took a long time to become law. SECURE 2.0 was first proposed in Congress in May 2021. The following describes some of the major provisions of the law. If you are looking at retirement, there may well be something in there for you.

Table of Contents

Required Minimum Distributions (RMDs):

One of the most consequential items for people approaching retirement is the postponement of RMDs from the current 72 years of age to 75, depending on the birth year.SECURE 2.0 resets RMDs to:

- 73 if you turn 72 from 2022‐2027

- 74 if you turn 72 in 2028‐2029

- 75 if you turn 72 in 2030 or later

This will allow retirees to alter their retirement plan by continuing their Roth conversions for a few years past the former limit of 72 or even to have some for those who have to start late.

The key benefit, of course, is that a Roth conversion allows a retiree with a relatively low tax bracket to make the conversions at a relatively cheap cost . Unfortunately, when we have to take the RMDs, our tax brackets typically jump up, and Roth conversions can become uneconomical .

Why would a retiree want to do a Roth conversion? For one, a Roth conversion can allow retirees to manage their taxes better . They may need to take more money out of their IRA in future years and thus pay a larger tax. If they have a Roth, they could take a distribution if they qualify, thus avoiding jumping tax brackets. The Roth conversion could allow them to arbitrage their taxes and reduce their lifetime tax bill.

Another intriguing opportunity is legacy planning. An inherited IRA must be fully disbursed within ten years of inheritance . That can be quite inconvenient for heirs as they will be responsible for paying income taxes they would incur upon distributions. Depending on the age and situation of the heir, the inheritance could come in their peak earning years and thus end up being smaller after taxes than anticipated. More time for the parents to work with Roth distributions can help alleviate the issue.

These are just a few possibilities that a later RMD requirement can allow. Check-in with me to see how it may affect your situation.

IRA RMD penalties

Previously, there was no statute of limitations to IRA penalties. Even though IRS penalties and interests on most tax issues have a 3-year statute of limitation, there is no such thing for IRA penalties . The IRS could assess penalties and interest for missed RMD years after the event.

Unfortunately, missing an RMD is common. However, most people do that as a mistake.

It seems unfair to apply penalties and interest forever. Our government has decided to agree: SECURE 2.0 fixes that issue by applying the same statute of limitation to the IRA RMDs as it does to other tax issues .

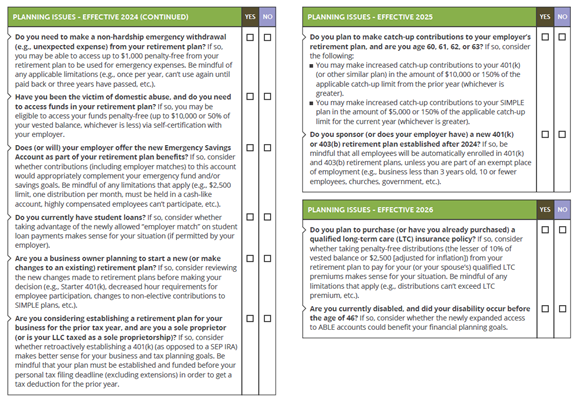

Catch-up contributions

SECURE 2.0 finally indexes IRA catch-up contributions for inflation .

Before this year, IRA contributions, including plan salary deferral, plan catch-up contribution, and plan overall limits, were indexed for inflation. However, until the end of 2022, the IRA catch-up contribution limit was not. It had to be increased by legislation, which only happened once… in 2006!

The law also creates new plan catch-up contribution limits in years a participant turns 62, 63, and 64.

Such participants (62- to 64-year-old) have the following catch-up contribution limits beginning in 2023:

- 401(k)s and similar plans: $10k ($6.5k today)

- SIMPLE: $5k ($3k today)

At first glance, this is nice, but I can’t help but notice that Congress seems very interested in helping 62- to 64-year-olds save for retirement, but not 65, 66, and 67-year-olds. They go out of their way to ensure you that at 65 or later, you are out of luck. It would seem logical to increase the limit up to 67, especially since Full Retirement Age for Social Security can go that late.

Catch-up contributions to Roth

One of the peculiar points of the new law is that it requires savers to make all catch-up contributions to Roth accounts!

It’s interesting because not all plans, such as the SEP and SIMPLE IRAs, have Roth options. Many regulations will have to change to accommodate that new legal provision!

The only reason I can think of for that provision is that it allows the IRS to collect taxes now and not let them defer. However, people love their Roth accounts, so it’s all good, even though it is likely to increase taxes during working years for some.

SEP and SIMPLE Roth accounts

Continuing on this Roth trend, the law allows the creation of SEP and SIMPLE Roth accounts. For some reason, SEP and SIMPLE have not had a Roth option until now.

Further, individual employees will be able to direct the employer matching contributions to the Roth side.

This is great news for employees of smaller companies as it gives them more planning flexibility.

QCD rules

The Qualified Charitable Distribution (QCD) allows taxpayers to make charitable contributions directly from an IRA to a non-profit . This allows the taxpayer to decrease their balances and their RMDs and associated income taxes. It’s a convenient provision that presents interesting planning opportunities for charitably and tax-minded individuals.

Currently, the QCD is limited to $100,000 a year. SECURE 2.0 indexes that amount to inflation .

The law also allows a one-time QCD, up to $50,000, to a split-interest entity such as a Charitable Remainder Trust (CRUT), a Charitable Remainder Annuity Trust (CRAT), or a charitable gift annuity. However, it’s not clear that it is cost-effective to establish a CRUT or a CRAT for this relatively small amount.

RMD penalties

Many know there is a 50% penalty for missing an RMD. The new law reduces it to 25% . The penalty is further reduced to 10% for timely and appropriately corrected errors within the “correction window,” which could be as long as three years. Sounds great, but right now, if you realize you missed an RMD but take corrective action and properly request relief, you’ll likely get a waiver of the 50% penalty.

It is still a 10% or 25% penalty, and you will be just as annoyed if you have to pay it, so plan accordingly.

Qualified student loan payments

This is great for borrowers who can now better pay their loans and save for retirement. It is also great for employers who can now provide an additional benefit for employees they want to retain.

529 Rollovers

Beginning in 2024, 529 beneficiaries will be able to roll over their account directly to a Roth IRA with no tax and no penalty ! This is great for people who have overfunded their 529 accounts.

There are a number of limitations, including the amount and the length of time that the account must have been held. It is one of the more complicated benefits of SECURE 2.0, so consult with your Certified Financial Planner.

In a scenario by industry pundit Michael Kitces, a child with an overfunded 529 could rollover over time the maximum of $35,000 to a Roth account and could end up with more than $1M at retirement. The power of compounding still amazes me!

These significant features of SECURE 2.0 change the retirement landscape significantly for many in pre-retirement or retirement. However, there are many more obscure and technical provisions of that new law. It will pay to consult with a specialist. What is obscure and technical to me could be quite interesting to you!

To learn more about how this can impact your financial outlook, visit Insight Financial Strategists, or schedule a complimentary call,

(1): I should note that it is impossible to guarantee future returns.