When mediating a divorce settlement, a 50-50 split of assets isn’t always equitable when Social Security benefits are taken into account . Let’s explore some examples.

The complexities of Social Security retirement benefits make it a difficult topic for divorce settlement negotiations. It is an exceedingly important source of income for retirees, especially divorced and even affluent retirees. Therefore, Social Security’s place in a person’s retirement income plan is a critical item for mediators, divorce financial planners, lawyers and their clients to understand to achieve the elusive goal of a fair and equitable settlement.

The maximum benefit in 2023 is $54,660 a year. Of course, most people don’t get the maximum. Still, as the benefit decreases, I find that it constitutes a greater percentage of income. And, because state courts do not have jurisdiction over SS allocation, its impact tends to be overlooked in settlement negotiations .

How does it work in practice? Take Jack and Jill, who are retired and are both 66. Each has a house of equal value (to simplify), $1.7 million in their IRAs and $300,000 in other liquid assets for a total of $2 million. For Jack and Jill, a 50-50 division leaving each party with $1 million should be a fair division, right?

Maybe. But let’s first go over some Social Security background.

Table of Contents

A Short History

The Social Security Act, passed in 1935, included benefits for workers but not their spouses . At the time, women who did not work outside of the home could not qualify for Social Security retirement benefits. A sweeping series of amendments enacted in 1939 extended Social Security to spouses and minor children. Wives who had not earned a Social Security retirement benefit or whose retirement benefit was less than 50% of their husband’s qualified for the first time.

Catching up with a changing society, another reform extended Social Security retirement benefits to divorced wives in cases when the divorce happened after a marriage of longer than 20 years. The word “spouse” replaced the word “wife” in the 1970s, allowing husbands to collect retirement benefits on their ex-wives’ records .

Later, the length of marriage required to qualify for benefits after a divorce was reduced to 10 years. When SCOTUS legalized same-sex marriage in 2015, survivor and divorce benefits extended to same-sex couples .

This short history of Social Security shows how it has evolved. Ex-wives and ex-husbands can now all receive retirement benefits based on an ex’s work record .

However, qualifying conditions must be met. The rules can be confusing and challenging to keep track of, especially for those who have had more than one marriage and divorce or those whose ex-spouse has died.

Benefits for Divorced People

When a divorced spouse claims their benefit at full retirement age or later, they will qualify to receive 50% of their ex-spouse’s primary insurance amount (PIA), so long as they have not remarried before 60 years of age and their own benefit is less than 50% of their ex-spouse’s.

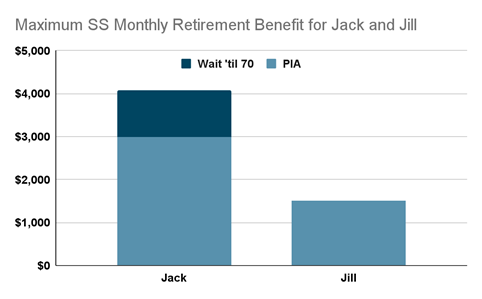

In Jack’s and Jill’s case, Jack’s PIA is $3,000 per month, and Jill does not qualify for a retirement benefit on her own record. She can file for her divorced-spouse benefit at her full retirement age of 66. She will qualify for 50% of Jack’s PIA, $1,500.

Note that if Jill had her own Social Security retirement benefit and it was more than 50% of Jack’s, she would receive only her own benefit. She would not also receive her divorced benefit!

Sometimes people wonder how the age difference with their ex-spouse can affect their benefits. The good news is that the ex-spouse’s age when they claim it is irrelevant. As long as Jill claims at full retirement age, she will receive her maximum divorce benefit independently of the timing of Jack’s claim.

Who Qualifies?

A person who claims benefits based on a former spouse’s record must be single at the time . So unfair, you say? If Jill has remarried, generally, she could get 50% of her new husband’s benefit, or her own, if her own is greater than 50% of her new husband’s. So let’s continue with a single Jill.

Jack may be married or unmarried. It makes no difference. If Jack is (re)married, Jill and the current wife could both qualify for the 50% benefit from Jack’s record.

Suppose Jill, who receives the 50% benefit, remarries. In that case, her 50% benefit from Jack’s record stops unless Jill’s new spouse also gets a divorced-spouse benefit. That’s except if the remarriage occurs after age 60.

Jill’s marriage must have lasted 10 years or longer to claim Social Security retirement benefits on Jack’s record . Because of that requirement, sometimes people who think of divorce will delay until 10 years of marriage are achieved. For example, if you’ve been married for 9.5 years, it may be worth waiting another six months. And with the slow speed of divorce proceedings, that is entirely possible without trying too hard!

Sometimes people are not sure when they got divorced. People often mark their court appearance date as the divorce date. In most states, however, the actual divorce date is later than the court appearance . For example, in Massachusetts, it is 90 or 120 days after the court appearance depending on the filing type.

More Marriages and Divorces

People sometimes ask: What if you had two or more 10-year marriages?

Then it can become complicated. Those who have divorced more than once after marriages of 10 years or longer get the higher of the two divorced-spouse benefits, so long as they are currently unmarried .

For example, suppose that Sheryl was married to Patrick for 20 years and then to John for 12 years. Sheryl has now divorced for the second time and has remained single for more than two years since her last divorce, from John.

Patrick’s PIA is $3,200, and John’s PIA is $2,800. So let’s suppose that Sheryl’s retirement benefit, based on her own record, is $1,200. However, she is at full retirement age (66 or 67, depending on her birth year).

When Sheryl files, she can receive $1,600, half of Patrick’s PIA, because it is higher than John’s $1,400 and her own benefit of $1,200. And, no, she cannot get both Patrick’s and John’s retirement benefits!

If Sheryl divorced less than two years before, she must wait until her last ex, John in this case, has filed for his benefit. In addition, the worker on whose record the retirement benefit is claimed, Patrick, must have reached 62 years of age.

Patrick’s filing status is irrelevant to Sheryl’s claim if they divorced more than two years before. So unless Sheryl tells him, Patrick will never know if his ex-spouse has claimed. In either Patrick’s or John’s case, their own benefits will not decrease based on Sheryl’s claim.

It should be clear by now that Social Security rules can be complex. Next, I will be covering issues that can occur when your ex passes away and when the retiree also gets a pension benefit. Finally, I will be bringing it together by looking at an example where the application of the rules results in Jill getting 35% less retirement income than Jack, even though their assets are divided 50-50.

When Your Ex dies

Mike and Marie are 66 and have been married for more than 10 years and divorced for more than two. Because Marie is single and not remarried, she qualifies for a divorced-spouse retirement benefit based on Mike’s record, whether or not Mike has filed.

If Mike has passed away, Marie receives a divorced-spouse survivor benefit based on Mike’s record if she is currently unmarried or if she remarried after age 60. In addition, Marie’s benefit will be 100% of Mike’s PIA, the amount that Mike would have received at full retirement age. In the case of Mike dying, Marie’s retirement benefits are capped to full retirement age.

What if the same two people have married, divorced, remarried each other and divorced again? In that case, the length of the two marriages can be added together (including the time in between) to reach the qualifying minimum of 10 years. That is, if the remarriage happens before the end of the calendar year following the divorce!

Say Mike and Marie were married for seven years, from May 2002 to August 2009. They remarried in December 2010 and divorced again in November 2013 for three years. The total for the two marriages is 10 years. Mike and Marie meet the 10-year requirement because their second marriage happened before the end of the calendar year after the first divorce.

If, instead, Mike and Marie had remarried in January 2011, the 10-year clock would have been reset to zero.

Pension Repercussions

In my previous article, Jill and Jack divorced, and she had no Social Security record of her own and met the requirements to receive half of Jack’s PIA of $3,000. But let’s consider what would happen if Jill had a record of her own.

When Jill applies for her divorced spouse’s retirement benefit, what if she also worked for an employer not participating in the Social Security system? For example, many state and municipal government employees are exempt from paying into the Social Security system . For instance, if Jill was a teacher for her town’s school system, in many states (but not all) she could qualify for a state pension. But then her divorced-spouse Social Security benefit would be reduced by two-thirds of the amount of her pension because of the Government Pension Offset (GPO) rule . As a result, Jill’s Social Security benefit may be zero, depending on the size of her pension.

How would that work? Jill currently receives a $3,000 monthly teacher pension in Texas. She has divorced Jack after more than 10 years of marriage. Jack’s PIA is $3,000. Jill’s divorced-spouse benefit of $1,500 would be reduced by $2,000 (two-thirds of $3,000), which reduces the benefit amount to zero. She doesn’t get any Social Security.

If Jack dies, Jill becomes eligible for a divorced-spouse survivor benefit. After the GPO reduction, she will receive $800 ($3,000 – $2,000 = $800).

Suppose the spouse with the benefit also qualifies for a pension from an entity that doesn’t pay into Social Security. In that case, the Windfall Elimination Program (WEP) kicks in . That reduces the spouse’s benefit payments, and the ex-spouse’s benefit adjusts downward as well.

Note that if Jill benefits from a pension but always paid into Social Security, she would not be subject to the GPO and WEP rules. She may have other challenges that require the help of a professional to sort out, but she would benefit fully from both her Social Security and her pension.

What Does It All Mean?

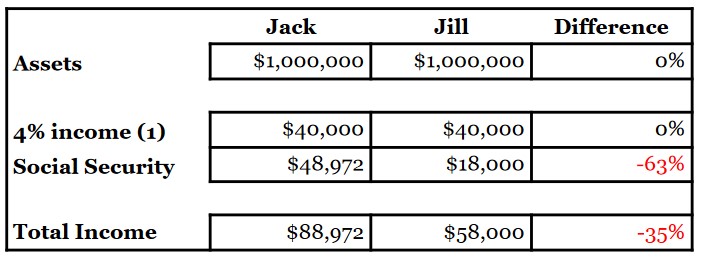

As a reminder, Jack and Jill are retired and decided to divide their assets 50-50. Jack also benefits from a $3,000 Social Security PIA retirement benefit, and Jill has a divorced-spouse benefit of $1,500. Jack opts to delay his Social Security until 70 when his benefit would increase to $4,081. Jill has no such option.

As detailed in the table below, Jack and Jill’s 50-50 division of assets may look fair. However, Jill’s income will be 35% less than Jack’s.

For couples that have fewer assets to divide, the difference is larger. For example, if Jack and Jill had $500,000 each and the other assumptions were the same, the difference would be 45%.

On the other hand, couples that have more assets have a smaller difference. For example, if Jack and Jill had $5,000,000 each and all the other assumptions remained the same, the difference in income would be $12%.

Last Words

In the example, the difference between Jill’s and Jack’s total incomes comes to slightly more than $2,500 a month. Over a 20-year lifetime, it can easily add up to more than $600,000. When you add Social Security cost-of-living adjustments (COLA), the difference could be more than $875,000.

The difference in Social Security income is not a challenge that can be dealt with directly in litigation, because the courts have no jurisdiction over Social Security . However, a couple mediating could potentially address the issue to achieve a more balanced retirement income for both and a more equitable settlement. Most likely, that would require the assistance of a divorce financial planner.

The example of Jack and Jill is simplified from cases we might run across. There may be other assets, such as a pension, a vacation home and rental real estate. There may be child support and alimony. Maybe Jill qualifies for her own Social Security benefit. There may be an inheritance looming. Jack and Jill may be further away from retirement. Their investment styles may differ.

Diverse circumstances will complicate the analysis, often beyond what can be easily handled by a lawyer or a mediator. However, it is crucial for a couple and their mediator and lawyers to understand the consequences of their decisions. That is so especially for women because they will need to stretch their assets to meet their longer statistical life expectancy .

I have a series of handy flow charts that can help guide mediators and clients through the decision complexities. Please ask for it at info@insightfinancialstrategists.com.

Note:(1) The 4% rule is widely used as a rule of thumb to estimate retirement income from assets . It was initiated in a 1994 study by Bill Bengen published in the Journal of Financial Planning. More recent revisions of the study imply that the safe withdrawal rule could be less than 4%. Other methods to plan retirement income may be more appropriate depending on the case.