[thrive_headline_focus title=”Doing the Solo 401(k) or SEP IRA Dance” orientation=”left”]

If you are self-employed, one of your many tasks is to plan for your own retirement. While most Americans can rely on their employer’s 401(k) for retirement savings, this is not the case for self-employed people.

In some respects, that is an advantage: most employees barely pay any attention to their 401(k). It is an opportunity for the self-employed to make the best choices possible for their business and personal situation.

The most obvious benefit of saving for retirement is that you will have to retire anyway, one day, and you will need a source of income then. With a retirement account, most people appreciate that it is specifically meant to save for retirement. People also appreciate the tax benefits of the SEP IRA and Solo 401(k).

The more immediate benefit is that retirement savings in tax-deferred accounts help reduce current taxes, possibly one of the greatest source of costs for small businesses. Of course, the tax saved with your contribution will have to be paid eventually when you take retirement distributions from the SEP-IRA.

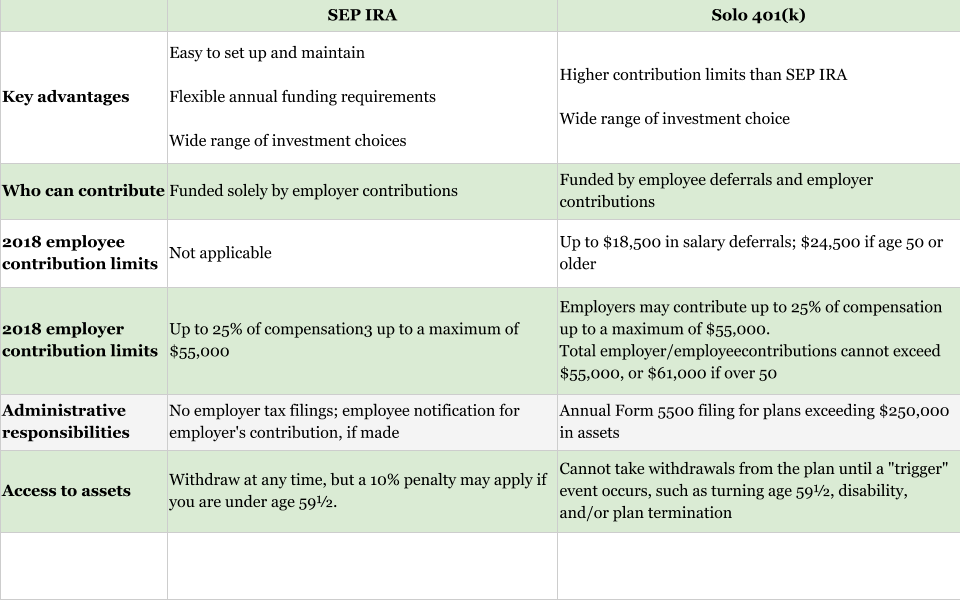

When it comes to tax-deferred retirement savings vehicles for the self-employed and owner and spouse businesses, two of them stand out due to their high contribution limits and flexible annual contributions: the SEP IRA and the Solo 401(k). These two vehicles provide a combination of convenience, flexibility, and efficiency for the task.

SEP IRA

The SEP IRA is better known by its initials than its full name (Simplified Employee Plan IRA). For 2018 the SEP IRA contribution limits are the lesser of 25% of compensation up to $275,000, or $55,000 whichever is less. You may note that this is significantly higher than the limit for most 401(k)s plans, except those that have a profit sharing option. SEP IRA rules generally allow contributions to be deductible from the business’ income, subject to certain SEP IRA IRS rules.

One of the wrinkles of SEP IRA eligibility is that it applies to employees: you have to make a contribution of the same percentage of compensation as you are contributing for yourself. So if you have employees, another plan such as a Solo 401(k) might be a better choice.

And for fans of the Roth option, unfortunately, the SEP IRA doesn’t have one. When comparing the SEP IRA vs Roth IRA, the two clearly address different needs.

Solo 401(k)

The Solo 401(k) also known as the individual 401(k) brings large company features to the self-employed. It generally makes sense for businesses with no common law employees. One of the Solo 401k benefits is that just owners and their spouses, if involved in the business, are eligible. Employees are not. So, if you are interested in just your own retirement plan (and your spouse’s), a Solo 401(k) may work better for you than a SEP IRA. If your business expands to include employees and you want to offer an employer-sponsored retirement plan as a benefit to them, then you should consider a traditional company 401(k) option.

The Solo 401(k) also known as the individual 401(k) brings large company features to the self-employed. It generally makes sense for businesses with no common law employees. One of the Solo 401k benefits is that just owners and their spouses, if involved in the business, are eligible. Employees are not. So, if you are interested in just your own retirement plan (and your spouse’s), a Solo 401(k) may work better for you than a SEP IRA. If your business expands to include employees and you want to offer an employer-sponsored retirement plan as a benefit to them, then you should consider a traditional company 401(k) option.

The Traditional Solo 401k rules work in the same way as the SEP IRA: it defers income taxes to retirement. It makes sense if you believe that you will be in an equal or lower tax bracket in retirement. Those who think that they may be in a higher tax bracket in retirement should consider a Roth option for their Solo 401(k): it will allow you to contribute now on an after-tax basis, and you will benefit from tax-free distributions from the account after retirement. A Roth 401k calculator may be required to compare the benefits. Again, the Roth option is not available in SEP accounts.

Solo 401k contribution limits permit you to contribute the same amount as you might in its corporate cousins: up to 100% of compensation, up to $18,500 a year when you are younger than 50 years old, with an additional $6,000 annual catch-up contribution for those over 50 years of age.

In addition, profit sharing can be contributed to the Solo 401(k). The Solo 401k limits for contributions are up to 25% of compensation (based on maximum compensation of $275,000) for a maximum from all contributions of $55,000 for those under 50 years of age and $61,000 for those over 50 years of age.

Another difference with the SEP IRA is that the Solo 401(k) can be set up to allow loans. In that way, you are able to access your savings if needed without suffering a tax penalty.

So Which Plan Is Best for You?

The SEP IRA is simpler to set up and administer. However, the Solo 401(k) provides more flexibility, especially for contribution amounts. Given that the amount saved is one of the key factors for retirement success, that should be a consideration.

Comparing the Solo 401k with the traditional employer 401k, you may no longer have to ask how to open a Roth 401k. You will have control of that. On the other hand you will be entirely responsible for figuring out your Roth 401k employer match.

As could be expected, administration of the Solo 401(k) is slightly more onerous than that of the SEP IRA.

Solo 401(k) and SEP IRA

A Last Word

If you don’t have a plan get one. It is easy. It reduces current taxes. And it will help you plan for a successful retirement. The SEP IRA and the Solo 401(k) were designed specifically for small businesses and the self-employed. Although we have reviewed some of the features of the plan here, there are more details that you should be aware of. Beware of the complexities!

Once you decide on the type of plan, it will be time to choose a provider that offers the features that you need, the investment choices that you need, and the guidance to help you maximize your hard earned savings.

At Insight Financial Strategists we help figure out what works for you and your retirement plansand show you how to set up a Solo 401k or a SEP IRA!