[thrive_headline_focus title=”What’s After The Bear Market?” orientation=”left”]

For the month ending 3/20/2020, the S&P 500 has been down almost 32%. Maybe it is because it’s happening right in front of us, but, somehow, the drawdown feels worse compared to history’s other bear markets.

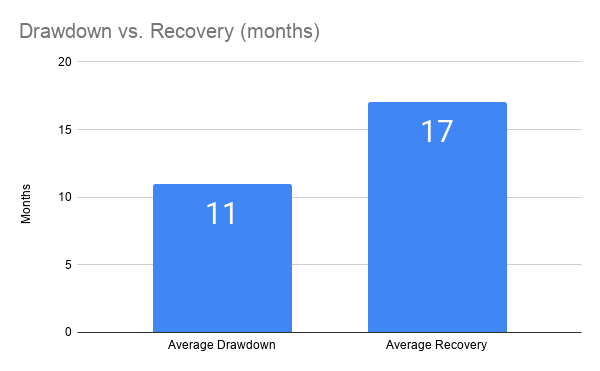

According to Franklin Templeton, there have been 18 bear markets since 1960 which is about one every 3.1 years . The average decrease has been 26.3%, taking a little less than a year from top to bottom.

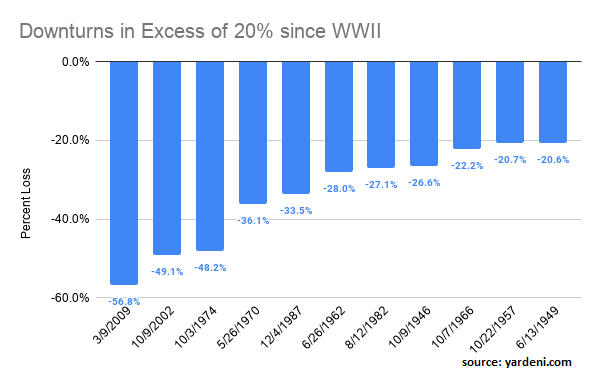

Financial planners often work with averages. But the reality is that each bear market will be different from the norm. At the time that I write this, the depth of this particular drawdown does not even rank with the worst in history. Sure, it may still get worse, but that’s where we are today.

We may not want to hear about how things will get better, because the situation with the Covid-19 pandemic and its resulting prescription of social isolation and market downdrafts is scary. But, eventually, things will get better.

Keep in mind that things may get worse before they get better. The count of people with the virus will almost certainly increase. If you don’t have a source yet, you can keep up with it over here. But eventually, the Coronavirus epidemic will run out of steam. We will get back to our places of work. Kids will go back to school. Financial markets will right themselves out. We will revert to standard toilet paper buying habits. We will start going out to eat again. Life will become normal again.

Financially, the question is not just how bad will things get, but how long it will take for our nest eggs to rebuild, so we can put our lives back on tr

Historically, since WWII, it has taken an average of 17 months for the S&P 500 to get back to its peak before a bear market .

The longest recovery since we have had reliable stock market records has been the Great Depression. The longest recovery post-WWII was in the wake of the dot-com crash at the beginning of this century. That took four years. The stock market recovery following the Great Recession of 2008 and 2009 took only 3.1 years .

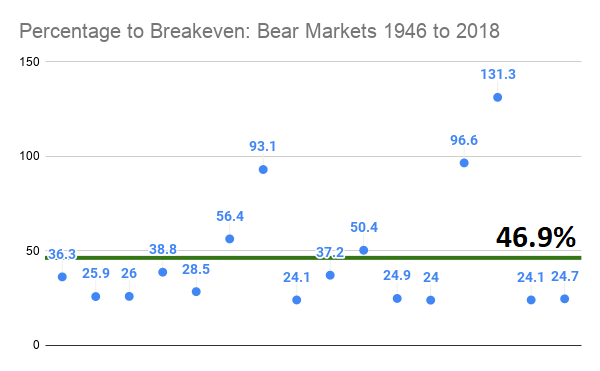

Hence, it could take us a while before we make it back to the previous market peak. However, we may want to look at the data differently. This graph shows that, historically, we have needed to achieve a return of 46.9% to recover from a bear market . According to Franklin Templeton calculations, these numbers can look daunting. However, they have been achieved and exceeded after every past downturn. While there is no guarantee, these numbers suggest that there will be strong returns once we have reached the bottom of the market. I like to think of this as an opportunity.

With the time that it takes for investments to grow and get your money back, there is time to take advantage of higher expected returns. For those who have resources available, this means that there is time to deploy your money at lower prices than has been possible in recent months.

Those of us who have diversified portfolios and are not in a position to make new investments, the opportunity is to rebalance to benefit from a faster upswing.

We know from history that every US stock market downturn was followed by new peaks at some point following.

Could this time be different?

Of course, that too is possible.

I like to think that the future will be better. We will still wake up in the morning looking to improve ourselves, make our lives better, and achieve our goals. We are still going to invent new technologies, fight global warming, and struggle for a more equitable society.

We are living through difficult times right now. Losses in our brokerage and retirement accounts are not helping. But we will get through this. Please reach out to me if you have specific questions or concerns.