Table of Contents

Retirement Bucket Strategy

What is the retirement bucket strategy? How does it work, and is this strategy right for you?

A key question for people retiring even with a healthy amount of assets is: is that going to last all the way?

So many elements go into answering that question. Still, on top of most people’s minds, one usually keeps them up at night: their investments.

And it makes sense: you can control your spending, social security is more or less a given, and Medicare and Medigap take care of most healthcare expenses. The biggest unknowns of our retirement are our lifespan and whether our investments will last all the way .

An effective retirement investment strategy is using the bucket investment strategy.

What Are The Three Buckets of Investing?

With the the retirement bucket strategy, retirees segment their spending needs into “buckets” depending on the time horizon of their spending . Of course, retirees can use as many buckets as they would like. However, for this discussion, let’s assume a 3 bucket investment strategy where the buckets can be arranged according to time horizon: near-term, medium-term, and long-term.

Retirees can use the immediate bucket to cover current living expenses and fund their lifestyle. Then they can use the intermediate bucket to refill the immediate bucket and the long-term bucket to refill the intermediate bucket. With a bucket retirement plan, each bucket pours into the next, creating multiple buckets or lines of defense between a retiree and adverse market events .

The immediate bucket

The near-term or immediate bucket covers near-term living and lifestyle expenses. That could be defined as 1-5 years. In the case of Insight Financial Strategists, we tend to use five years.

To cover current living and lifestyle effectively, the risk of investments in the immediate bucket needs to be kept low. Hence the immediate bucket is invested in low-risk instruments, even cash, to ensure that market events such as a sudden drop in values don’t affect the investment and the spending they are associated with.

Every year that passes reduces the money in the immediate bucket. With a five-year immediate bucket, there are only four years of expenses left after one year has passed. At that time, the immediate bucket is replenished from the intermediate bucket.

[pullquote align=”center”]The long-term bucket is invested in assets that are expected to bring higher returns [/pullquote]

The intermediate bucket

The role of the intermediate bucket is to get a better balance between risks and returns. While the immediate bucket is useful to tamp down short-term risk, too much in the immediate bucket would leave the retiree open to other risks, such as inflation, if the intermediate and long-term buckets did not complement it.

The amount budgeted in the intermediate bucket reflects spending and lifestyle needs after year 5 to another milestone. Our firm’s intermediate bucket covers expenses between the sixth and tenth year.

In addition to the time horizon, the risk embedded in the intermediate bucket reflects the investor’s risk tolerance. Typically this would result in a mix of stocks and bonds.

The allocation provides more growth potential than the low-risk immediate bucket and lower volatility than the long-term bucket. Because of that latter point, the intermediate bucket is expected to recover faster from a market downturn than the long-term bucket.

Assets from this intermediate bucket are typically used to replenish the immediate bucket as it dwindles.

The long-term bucket

Lastly, the long-term bucket aims to provide the portfolio with growth for assets expected to be used ten years or more in the future. In a retirement horizon of 20 years, 30 years, or longer, that is necessary to fight inflation and ensure that there will be enough in a retiree’s later years.

In a retirement bucket strategy, the long-term bucket is invested in assets such as stocks that are expected to bring higher returns , although with higher volatility. The volatility is acceptable in this bucket because the immediate bucket covers short-term needs, and long-term bucket funds are not needed for another 10+ years. Downturns caused by the increased volatility have historically recovered (1).

Graph 1: S&P 500 Performance

Graph 1 represents the performance of the S&P500 from 2005 to 2021. Clearly, downturns occur, notably from the end of 2007 to the beginning of 2009. However, in the long term, the market is positively biased (1).

How does it Work?

In years when the market is up, rebalancing happens normally. We replenish the immediate bucket from the intermediate bucket and the intermediate bucket from the long-term bucket. So if the market is up substantially, we might harvest more of the gains in case future years are less giving.

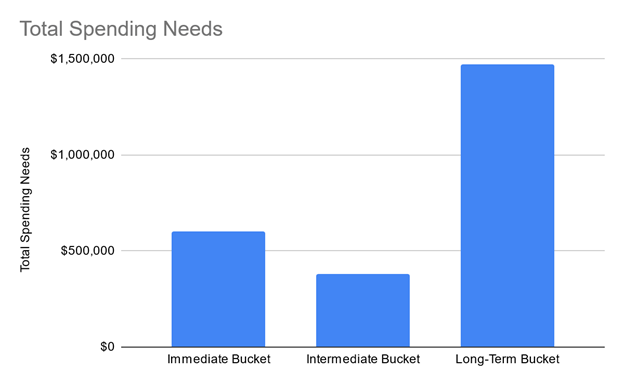

Graph 2: A Hypothetical Bucket Plan

Exact bucket sizing will depend on the retirees’ needs and lifestyles. Most retirees will have a steady source of income, such as Social Security. In 2023, the maximum Social Security benefit is $4,459 per month, equivalent to $53,508 per year. If that is the retiree’s only steady income source, we expect the immediate bucket to cover expenses above that amount. For example, the retiree’s immediate bucket in Graph 2 represents spending for the plan’s first five years including potential mortgage payments. When netting steady income, such as Social Security, the plan generates an income need that investments can cover.

Graph 3: Power of Compounding

A key reason to remain invested in the intermediate and long-term buckets is the power of compounding . This property allows money invested over a more extended period of time to grow substantially. For example, Graph 3 shows the difference in the value changes between a hypothetical investment and cash.

What are the benefits of a retirement bucket strategy?

There are a few distinct benefits of the retirement bucket strategy.

First, the financial planning needed to size retirement buckets properly can give retirees a great visual of how they can ride through retiremen t, living the life they prefer, yet without running out of funds. If the plan shows that it will be difficult, retirees can adjust their spending accordingly. Most people are surprised how even small changes in the parameters of a plan can result in outsized long-term effects.

Second, the bucket approach to investing can give retirees the peace of mind of knowing that their short-term needs will be taken care of regardless of market events . It will not stop people from worrying about what happens in the long-term bucket. After all, that’s where a lot of their resources are.

Third, financial planning gives the investor a stronger ability to plan taxes optimally. It allows a deliberate use of various accounts such as brokerage, Traditional retirement, and Roth accounts.

Fourth, it allows retirees to plan their legacy better. With the retirement bucket strategy, planning expenses and the resources needed to fund them enable the retiree to identify a legacy surplus if any. The excess funds can become an additional bucket focused on legacy planning. That allows the retiree to better think through how to help their children or their favorite causes. It enables them to plan the distribution of a legacy in a way that helps the children when they need it, which may be before the retirees’ death.

What are the drawbacks of a retirement bucket strategy?

Some critics claim that the retirement bucket strategy results in an investment strategy that is too conservative and overweighted in bonds. However, as we size the buckets according to a retiree’s spending needs, there is no overweighting or underweighting, just right-sizing. That perhaps is the best feature of the retirement bucket strategy: removing the uncertainty of arbitrary allocation and distribution strategies.

Other critics find the retirement bucket strategy challenging to maintain.

Working optimally, the retirement bucket strategy requires retirees to update their financial plans periodically . It also requires regular adjustments in investments. All of that can be complicated. However, the right software and skills help simplify the process.

Is the investing bucket strategy right for you?

If you need a retirement plan that allows you to

- Balance your short-term and long-term needs

- visualize your income and expenses, and visualize whether you will have enough for your lifetime.

- If you need to plan for a legacy without guessing how much you can spend, the bucket investing approach should be an option.

To learn more about the retirement bucket strategy, visit Insight Financial Strategists, or schedule a complimentary call,

Check out our blog post on Carrying a Mortgage in Retirement!

(1): I should note that it is impossible to guarantee future returns.